You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

This EU bailout still isn't a done deal. It could still fall apart.

But even if it doesn't, it doesn't change anything fundamentally. Much like TARP, etc. here in the USA, it just buys a little time while letting the core problem get much worse.

$.02

But even if it doesn't, it doesn't change anything fundamentally. Much like TARP, etc. here in the USA, it just buys a little time while letting the core problem get much worse.

$.02

Good write up here:

More: http://truthingold.blogspot.com/2011/10/eu-rescue-plan-whole-lotta-nuthin.html

The EU "Rescue" Plan: A Whole Lotta Nuthin

Long on political hot air and rhetorical concepts, short on details and achievability. Eventually the EU will require a couple trillion more in money printing/currency devaluation and the EU banks will require a Taxpayer bailout. That's the bottom line if you don't want to read the rest and I've linked the actual plan below.

The Euro Summit produced the outline of a Greece/bank "rescue" plan that really is a fantasy plan of action more suited for children playing “slay the evil beast” video games with their Wii. In effect it does nothing to reduce absolute debt levels, it does nothing to address the core economic and financial problems that created the EU insolvency in the first place and it offers no real concrete plan for raising the necessary capital to fund the "rescue" plan. In short, this plan of action is about as real as that of the 2008 bank bailout by the U.S. Government/Taxpayer, which has actually led to a much bigger version of the same problems left unattended in 2008. The bottom line is that the EU game plan - unless Sarkozy can bamboozle the Chinese into coughing up $100's of billions in support, will require more money printing and EU Taxpayer wealth transfer to the big banks.

As I dig into and digest the detail of this Greek/EU bank bailout outline, it becomes obvious that this plan is very long on form and very empty on real substance. In addition to the 2008 U.S. bank bailout, it is also analogous to the debt limit extension agreement by Congress and Obama, which outlined a game plan to reduce debt over the next decade starting a few years from now, but enables further current increases in debt accumulation and money printing.

...

More: http://truthingold.blogspot.com/2011/10/eu-rescue-plan-whole-lotta-nuthin.html

KMS

Big Eyed Bug

And of course we all know that the best way to fix debt is with more debt...

The WSJ breaks down the EU deal a bit and concludes that the Emporer isn't wearing any clothes:

Details: http://online.wsj.com/article/SB100...71498250002.html?mod=WSJ_Opinion_AboveLEFTTop

...

In short, everyone is bailing out everyone. The larger problem betrayed by yesterday's agreement is that European leaders continue to act as if they are mainly dealing with a crisis of confidence, which can be restored with evermore far-reaching bailout schemes. Absent from this week's communiqués are any new ideas for promoting the structural economic reforms—both at the periphery and at the center of the euro zone—that might create real confidence in the euro zone's long-term economic prospects. The new bailout money Greece is getting doesn't even come with new conditions for implementing structural reforms, as the first bailout package did.

Not surprisingly, markets rallied at yesterday's news, with the euro gaining 2.4% against the dollar. That isn't the first time a Brussels summit has triggered a burst of market relief. But without economic growth and more fundamental reform, yesterday's deal will merely be the latest palliative.

Details: http://online.wsj.com/article/SB100...71498250002.html?mod=WSJ_Opinion_AboveLEFTTop

Looks like the markets are reacting to news that this EU deal may fall apart. Buying opportunity coming?

DoChenRollingBearing

Yellow Jacket

Europe? European deal?

Well, OK, they have made a sort-of deal re Greece and its debt. But, as we all know (and was stated above), this is just the beginning...

Whither Europe? IMO, Europe will likely not be a good place to invest (being overly general here) for the foreseeable future.

Why so bleak re our friends over there? Because there are so many languages and agendas all over. Not to mention bad demographics. And THEIR immigration problems (we have our problems with illegals (yes I know that some of ours are MS-13, etc.), but their immigrants are MUSLIM. I'll take our problem vs. theirs.

Just today I read that a Muslim Serb took a few potshots at our embassy in Sarajevo (Sarajevo, again?).

So, naah re Europe as a place to move to or a place to invest much in. I'll stay here, or if things get bad, Mr. and Mrs. Bearing may just roll down to Peru (where my wife came from and where we have our bearing import business).

Well, OK, they have made a sort-of deal re Greece and its debt. But, as we all know (and was stated above), this is just the beginning...

Whither Europe? IMO, Europe will likely not be a good place to invest (being overly general here) for the foreseeable future.

Why so bleak re our friends over there? Because there are so many languages and agendas all over. Not to mention bad demographics. And THEIR immigration problems (we have our problems with illegals (yes I know that some of ours are MS-13, etc.), but their immigrants are MUSLIM. I'll take our problem vs. theirs.

Just today I read that a Muslim Serb took a few potshots at our embassy in Sarajevo (Sarajevo, again?).

So, naah re Europe as a place to move to or a place to invest much in. I'll stay here, or if things get bad, Mr. and Mrs. Bearing may just roll down to Peru (where my wife came from and where we have our bearing import business).

News from this morning looks like the Greeks are going to torpedo the EU deal. They are discussing early elections to hold a referendum on the required austerity measures that are a pre-requisite for the deal. The Greek people are sure to vote it down should a vote be held.

And while rumors of Germany preparing for a return to the Deutsche Mark have been circulating for a while, I'm now hearing rumblings that Italy may be the first to bolt the EU and return to the Lira:

http://www.zerohedge.com/news/will-italy-re-denominate-back-lire

And while rumors of Germany preparing for a return to the Deutsche Mark have been circulating for a while, I'm now hearing rumblings that Italy may be the first to bolt the EU and return to the Lira:

http://www.zerohedge.com/news/will-italy-re-denominate-back-lire

DoChenRollingBearing

Yellow Jacket

Europe just keeps getting sicker by the day, and Jon Corzine (with HIS bad bet on Euro-debt) is the sicko who has now kicked over a whole new set of dominoes here in the US. BIG plunges in equities in just 2 days.

-- Greece to have a referendum on the "Deal" they sort-of had

-- Portugal, widely seen as the next domino in Europe

-- Spain, in really bad shape, very high unemployment

-- Ireland? Have not read much on them lately

-- Italy, puts all of Europe in peril, TBTF? TBTSave?

and (maybe)

-- France, game over for the Euro

and

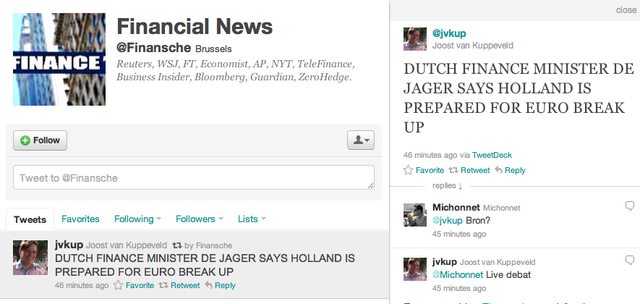

-- Holland, Finland and Germany thinking about getting OUT

I just listed 9 countries in Europe with issues, but I did not list all of them (Belgium: no government!). And, NO, Germany is not strong enough to carry the burdens of a battered Europe. If the all of the Euro-dominoes all click-clack to the floor, then our banks are toast as well. If Europe goes, we follow.

But, that's why WE are here in pmbug.com. We are a small community that has recognized that it is up to each of us to look after ourselves. To preserve any wealth we each may have. Whether it's Europe that brings us down, or an EMP, or a power grab by the elites, it is up to each of us.

Gold, bitchez! Be ready, get physical. If our friend FOFOA is right, we're looking at $55,000 non-hyperinflated 2009 US$. FOFOA is my Trail Guide... Reading his blog and understanding "Freegold" takes a LOT of work and mental energy (at least for me), but without him, I would have far fewer ounces.

And in the end, it's all about the ounces.

fofoa.blogspot.com

-- Greece to have a referendum on the "Deal" they sort-of had

-- Portugal, widely seen as the next domino in Europe

-- Spain, in really bad shape, very high unemployment

-- Ireland? Have not read much on them lately

-- Italy, puts all of Europe in peril, TBTF? TBTSave?

and (maybe)

-- France, game over for the Euro

and

-- Holland, Finland and Germany thinking about getting OUT

I just listed 9 countries in Europe with issues, but I did not list all of them (Belgium: no government!). And, NO, Germany is not strong enough to carry the burdens of a battered Europe. If the all of the Euro-dominoes all click-clack to the floor, then our banks are toast as well. If Europe goes, we follow.

But, that's why WE are here in pmbug.com. We are a small community that has recognized that it is up to each of us to look after ourselves. To preserve any wealth we each may have. Whether it's Europe that brings us down, or an EMP, or a power grab by the elites, it is up to each of us.

Gold, bitchez! Be ready, get physical. If our friend FOFOA is right, we're looking at $55,000 non-hyperinflated 2009 US$. FOFOA is my Trail Guide... Reading his blog and understanding "Freegold" takes a LOT of work and mental energy (at least for me), but without him, I would have far fewer ounces.

And in the end, it's all about the ounces.

fofoa.blogspot.com

Last edited:

... it's all about theBenjaminsounces.

...

I like it. :clap:

I have always maintained that individuals act in their own perceived self interest. Lack of information or perspective can prevent big picture views or long term solutions.

I don't have much faith in anyone* being able to fix the global fiat nightmare we face. This is why I consider it prudent to prepare for economic collapse while hoping the preparations never need be put into use.

*I believe Ron Paul's competing currencies idea offers some hope for getting the ball rolling in the right direction, but the American people have a long way to go before they understand the need for it much less start demanding it.

I don't have much faith in anyone* being able to fix the global fiat nightmare we face. This is why I consider it prudent to prepare for economic collapse while hoping the preparations never need be put into use.

*I believe Ron Paul's competing currencies idea offers some hope for getting the ball rolling in the right direction, but the American people have a long way to go before they understand the need for it much less start demanding it.

Reading ZH this morning and it looks like extreme volatility ahead. Watch your cornholes people.

France-bund spread explodes:

http://www.zerohedge.com/news/france-downgrade-rumor-france-bund-spread-explodes

China bailout rumor crumbles as ESFS pulls bond:

http://www.zerohedge.com/news/lates...d-due-market-conditions-france-bund-spread-re

France-bund spread explodes:

http://www.zerohedge.com/news/france-downgrade-rumor-france-bund-spread-explodes

China bailout rumor crumbles as ESFS pulls bond:

http://www.zerohedge.com/news/lates...d-due-market-conditions-france-bund-spread-re

No IMF, EFSF Participation In European Bailout: Merkel Says G20 Fails To Reach Agreement On IMF Resources, Nobody Wants Any Piece Of EFSF:

http://www.zerohedge.com/news/no-im...-says-g20-fails-reach-agreement-imf-resources

EU deal looking less and less viable. Markets will fall until the next rumor about a deal to save (prolong in reality) the day.

This game won't last forever. The clock is ticking.

http://www.zerohedge.com/news/no-im...-says-g20-fails-reach-agreement-imf-resources

EU deal looking less and less viable. Markets will fall until the next rumor about a deal to save (prolong in reality) the day.

This game won't last forever. The clock is ticking.

...

Merkel said Europe's plight was now so "unpleasant'' that deep structural reforms were needed quickly, warning the rest of the world would not wait.

"That will mean more Europe, not less Europe,'' she told a conference in Berlin.

She called for changes in EU treaties after French President Nicolas Sarkozy advocated a two-speed Europe in which euro zone countries accelerate and deepen integration while an expanding group outside the currency bloc stayed more loosely connected — a signal that some members may have to quit the euro if the entire structure is not to crumble.

Merkel Calls for 'Breakthrough to a New Europe'

"It is time for a breakthrough to a new Europe,'' Merkel said. "A community that says, regardless of what happens in the rest of the world, that it can never again change its ground rules, that community simply can't survive.''

A senior EU official said changing the make-up of the euro zone has been discussed on an "intellectual" level but had not moved to operational or technical discussions, while a French government source said there was no such project in the works.

...

More: http://www.cnbc.com/id/45225209

Desperately trying to keep it together, but unless they fix the core issue (which they can't), it won't mean anything.

KMS

Big Eyed Bug

A senior EU official said changing the make-up of the euro zone has been discussed on an "intellectual" level but had not moved to operational or technical discussions, while a French government source said there was no such project in the works.

Probably because it doesn't include France. /shrug

As long as they don't start discussing the annexation of the Sudentenland, we should be OK.

'We're making plans for the collapse of the euro': Cable reveals contingency as debt crisis sparks fears Britain could be dragged into a second recession...

- Head of the IMF says there is a risk of a 'lost decade'

- David Cameron warns crisis is placing Britain in 'clear and present danger'

- Italy debt is so large it cannot be bailed out

- Markets across the globe fall in response to the news

- Worries France could be next country to fall victim

- George Osborne vows to continue deficit-cutting measures

More: http://www.dailymail.co.uk/news/art...crisis-Fears-UK-dragged-second-recession.html

This is a fantastic interview with Citi's Willem Buiter on Bloomberg TV.

You can hear the anger in his voice as he argues that Europe may have a matter of days before an unnecessary default and a financial catastrophe.

The answer: the ECB must act fast, and ignore the Germans who don't get it. While some people don't think that the ECB can really monetize sovereign debt this way, Buiter believes there's absolutely nothing preventing the ECB from doing whatever it wants on the secondary market.

...

Buiter on Europe's crisis:

"Time is running out fast. I think we have maybe a few months -- it could be weeks, it could be days -- before there is a material risk of a fundamentally unnecessary default by a country like Spain or Italy which would be a financial catastrophe dragging the European banking system and North America with it. So they have to act now."

"The only two guns in town, one is only theoretical, and that is increasing the size of the EFSF to 3 trillion. It should happen but it can't for political reasons. The other one, the only remaining share is the ECB. They may have to hold their noses while they do it, and if they don't do it, it's the end of the euro zone."

...

More: http://www.businessinsider.com/must...e-days-before-a-financial-catastrophe-2011-11

Willem Buiter is just another voice shouting at the EBC to get printing.

There does seem to be more concern tending towards panic in recent days though.

What puzzles me is why there isnt more open discussion about the great reset, that to me seems inevitable.

Ok its got to be kept under wraps from J6P but its a major event and will need careful co-ordination.

Have they fixed a date for this and as a result are getting stressed because the euro zone might break before the agreed date ?

There does seem to be more concern tending towards panic in recent days though.

What puzzles me is why there isnt more open discussion about the great reset, that to me seems inevitable.

Ok its got to be kept under wraps from J6P but its a major event and will need careful co-ordination.

Have they fixed a date for this and as a result are getting stressed because the euro zone might break before the agreed date ?

ancona

Praying Mantis

A Eurozone breakup is the best thing for Europe, but will be a thorn in the banksters ass. This will cost them trillions. I like it.