What it needs is honest government ministers of integrity.I think it's a misconception to think that the Gold Standard needs the monetary authorities - the managers of the national currency - to do something.

Gold Standard means using gold - i.e. a currency representing a fixed quantity of gold - as everyday currency.

When buyer and seller transact in gold, that's for me is Gold Standard.

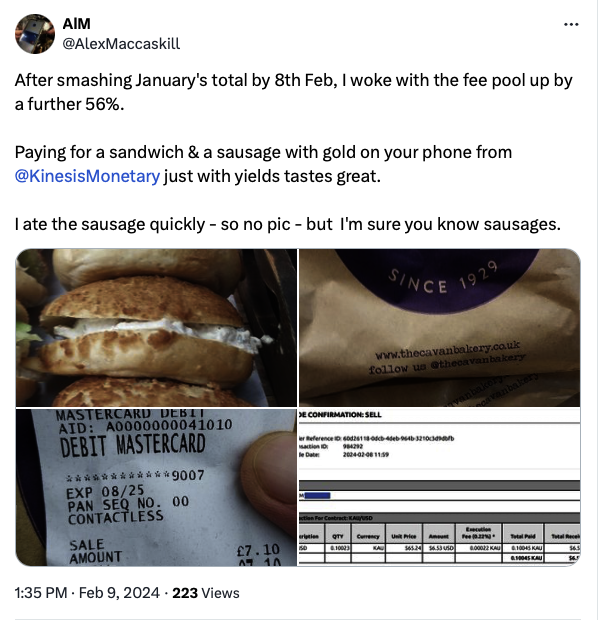

E.g. using Kinesis' KAU is Gold Standard.

The Fed is not necessary in order to build and expand the Gold Standard. It's up to the people.

We have none, now. It doesn't matter, because we'll not get a gold standard until the hard reset happens (the opposite of Davos Man's masturbatory Grate Reset) - the natural end of when avarice collides with idiocy in a hubris fog.

THAT will cleanse things. How it goes from there, a crap shoot - if we can rediscover basic morality and return to the principles underlying this nation's founding (decentralization of government, morality, relearning that the citizen is sovereign, the family is essential, the community is the structure, the States have plenary powers and the States created and must control the Union.

But half our populace wants some sort of collectivist - fascist government.

We will see. But we'll not see any serious moves to end our debt-based economy with fiat currency.