swissaustrian

Yellow Jacket

- Messages

- 2,049

- Reaction score

- 0

- Points

- 0

The EU finance ministers decided yesterday that all depositors at Cyprian banks will have to pay for the bailout of the government, regardless of whether their bank is in trouble or not. Collectivism at it's best. It's also gonna hit local and smaller depositors more heavily, because smart money (Russian money launderers and hedge funds) has left the country long ago anyway. This is a primary example of the immorality of bailouts. There are bank runs happening all over Cyprus today, but the bailout tax has already been substracted from the account balances. I also haven't read a word about the participation of government and/or bank bondholders in the bailouts. It seems they haven't been asked to give something which makes perfect sense, because the bondholders are mainly foreign banks and not domestic depositors...

I'm predicting that this is gonna cause capital flights from other weak Eurozone countries' banks to "safe" countries like Germany, the Netherlands or Finnland, thereby increasing the Target2 ( http://en.wikipedia.org/wiki/TARGET2#Relation_to_European_sovereign_debt_crisis_and_criticism ) imbalances between the Eurozone countries.

Here's the news by AFP:

I'm predicting that this is gonna cause capital flights from other weak Eurozone countries' banks to "safe" countries like Germany, the Netherlands or Finnland, thereby increasing the Target2 ( http://en.wikipedia.org/wiki/TARGET2#Relation_to_European_sovereign_debt_crisis_and_criticism ) imbalances between the Eurozone countries.

Here's the news by AFP:

http://www.google.com/hostednews/af...docId=CNG.4339e45bc5c512fa24c45ef2921cd51a.21Cyprus depositors hammered in radical EU-IMF bailout

By Roderick Thomson (AFP) – 6 hours ago

BRUSSELS — Eurozone leaders and the IMF on Saturday announced an unprecedented levy on all deposits in Cypriot banks as the sting in the tail of a 10-billion-euro bailout for the near-bankrupt government in Nicosia.

Intended to apply to everyone from pensioners to Russian oligarchs alleged to have billions stashed away in what officials say is a bloated Cypriot banking sector, the "stability levy" immediately raised a flood of concerns among finance experts over a possible bank run in bigger eurozone economies, where fragile public finances are also under scrutiny.

Dutch Finance Minister Jeroen Dijsselbloem, after chairing some 10 hours of talks to strike the deal with counterparts including International Monetary Fund head Christine Lagarde and the European Central Bank's Mario Draghi, said the "upfront, one-off" tax is expected to raise 5.8 billion euros on top of the loans still to be finalised by eurozone parliaments.

The levy will see deposits of more than 100,000 euros in Cypriot banks hit with a 9.9 percent charge when lenders re-open their doors on Tuesday after a scheduled bank holiday on Monday. Under that threshold and the levy drops to 6.75 percent.

Top ECB official Joerg Assmussen said the only way to drive down what was originally requested as a 17-billion-euro rescue was to claw back money from the Cypriot banking sector, which is estimated to hold assets worth five times the country's economic output.

"In order to have burden-sharing, you extend the tax base," Asmussen said. "To residents and also to non-residents."

Lagarde said she would recommend that the IMF board now agree to chip in what one diplomat said could amount to another billion euros ($1.3 billion) in loans.

Lagarde said "the exact amount is not yet specified and will take a little bit of time" to arrive at.

Officials including the EU's economy and euro commissioner Olli Rehn also cited "positive" parallel talks with Russia on possibly easier terms on a 2.5-billion-euros loan it gave to the Cypriot government.

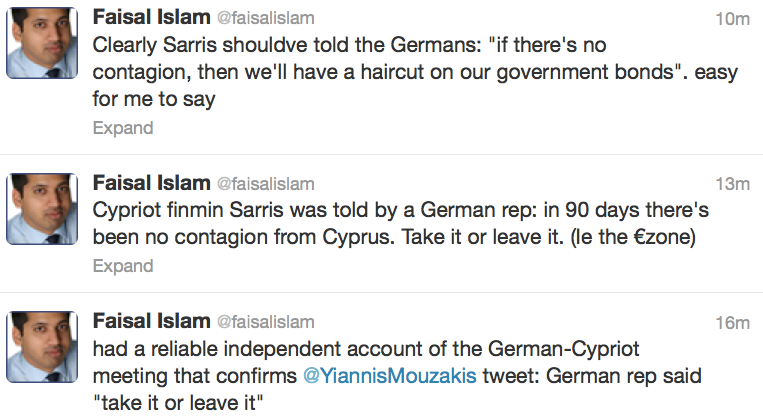

Cyprus Finance Minister Michalis Sarris will reportedly fly to Moscow for talks Monday about extending that loan, due to be repaid in 2016.

Under the deal, the Cyprus government will also have to hike corporate tax to 12.5 percent from 10 percent and sell off state assets so as to help balance the public finances.

"As it is a contribution to the financial stability of Cyprus, it seems 'just' to ask a contribution of all deposit-holders" to the rescue, Dijsselbloem said.

"The challenges we were facing in Cyprus were of an exceptional nature," the Dutchman said, under tough questioning from journalists at a press conference after the meeting in Brussels.

"We did what we had to," said French Finance Minister Pierre Moscovici on exiting the talks.

"It's something that compared to other possible outcomes, is the least onerous," said finance minister Sarris,

This arrangement notably meant his government "avoided salary and pension cuts" for public sector workers, he said.

Cyprus accounts for just 0.2 percent of the combined eurozone economy but officials said it had to be bailed out to safeguard the principle that no eurozone state could be allowed to default and so compromise the credibility and integrity of the single currency.

A "withholding tax" will also be imposed at source on interest earned in Cypriot banks in a further hit .

The talks had dragged on as the Cypriot government fought its ultimately doomed battle to avoid a "bail-in" or haircut, which it argued would trigger a run on its banks and ricochet on through the wider eurozone financial system.

Cyprus President Nikos Anastasiades attended the talks.

The Cyprus price tag is very small compared with two rescues for Greece worth some 380 billion euros ($496 billion), Ireland's 85 billion euros, Portugal's 78 billion and 41 billion for Spanish banks.

Russians are among the biggest investors in Cyprus, and hardline lenders like Germany had pressed for months for a clampdown on banks' alleged involvement in money laundering.

The total annual output of the Cypriot economy is 17 billion euros, and the IMF was concerned that a bailout on that level would take the country's debt burden to unsustainable levels.

Copyright © 2013 AFP. All rights reserved.

Last edited: