So change the compliance rules or find ways to get the money to go where its needed.

If the problem is a lack of money and the Feds only tool is to print more of the stuff, then this has to be a fixable problem .......

hmmm

As usual passing the buck and putting the blame for JPM stepping away from the repo market - and catalyzing the Sept 16 repo rate explosion - on regulators, Dimon said his firm had the cash and willingness to calm repo markets when they went haywire in September, but regulations held it back.

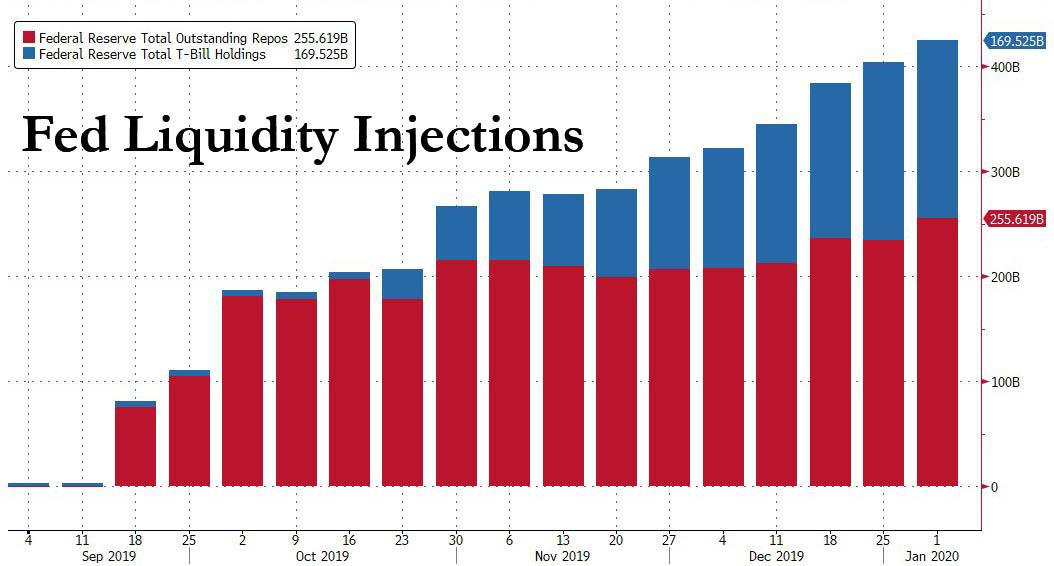

Meanwhile, as part of stepping away from the repo market, JPMorgan succeeded in forcing the Fed to restart not only repo operations, but also QE. As a result, the Fed began daily liquidity injections, and even as repo rates have since returned to more normal levels, the Fed has also resumed purchases of Treasuries to bolster bank reserves.

from - https://www.zerohedge.com/geopoliti...et-eases-sharply-mnuchin-says-may-loosen-gsib

It's also why Jamie Dimon is hoping to fully deregulate the financial system, so that he has no longer has any constraints on what his balance sheet should look like. And if regulators needs a little more "convincing", JPM is happy to crash the repo market as many times as is necessary.