Well, I let this one slide for a good while. However, I happened to read this dispatch on gata.org today:

...

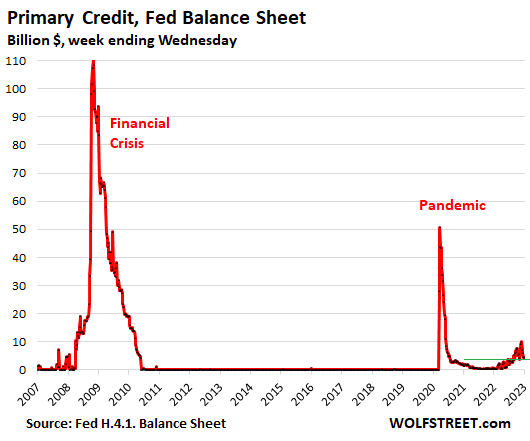

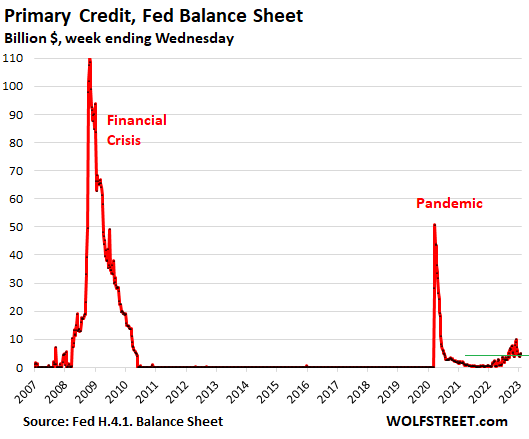

The extent of "quantitative tightening" reported by the Fed yesterday is still far below the Fed's initial claim that it would be running off $60 billion of government debt per month and $35 billion of mortgage debt. The Fed's assets appear to have peaked in the weekly reports on March 23 at $9,012 billion and yesterday's report was $8,924 billion. ...

gata.org

So, I decided to have a look...

5/5/22 - $8.989T ($1B increase from week prior)

5/12/22 - $8.991T ($2B increase from week prior)

5/19/22 - $8.995T ($4B increase from week prior)

5/26/22 - $8.963T ($32B decrease from week prior)

6/2/22 - $8.964T ($1B increase from week prior)

6/9/22 - $8.967T ($3B increase from week prior)

6/16/22 - $8.982T ($15B increase from week prior)

6/23/22 - $8.983T ($1B increase from week prior)

6/30/22 - $8.962T ($21B decrease from week prior)

7/7/22 - $8.941T ($21B decrease from week prior)

7/14/22 - $8.945T ($4B increase from week prior)

7/21/22 - $8.948T ($3B increase from week prior)

7/28/22 - $8.939T ($9B decrease from week prior)

8/4/22 - $8.924T ($15B decrease from week prior)

They appear to be shrinking the balance sheet, but not nearly as fast as they had announced.