You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Crypto trading/market thread

- Thread starter pmbug

- Start date

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

- Status

- Not open for further replies.

- Messages

- 34,387

- Reaction score

- 5,828

- Points

- 288

Users cry foul as MEXC freezes assets and blocks accounts

In a startling series of events, the crypto exchange MEXC has been at the center of a brewing storm, following allegations of freezing traders’ accounts and seizing their funds. These actions, which MEXC attributes to “abnormal trading activities,” have sparked a wave of outcry and consternation within the crypto community. As the details unfold, the narrative weaves a tale of caution and mistrust in the volatile world of digital currency exchanges.The first ripples of discontent surfaced around December 16, when MEXC users started voicing their frustrations over restricted access to their accounts. A trader, known pseudonymously as Vida, became the face of this unrest, reporting a loss of $92,000 in Tether (USDT) following profitable trades in the exchange’s futures market.

More:

I've never heard of MEXC before.

coinmarketcap.com

coinmarketcap.com

...

The exchange serves over 200 countries and more than 6 million users. It holds key licenses in countries like Australia, Estonia and the United States.

...

The company is headquartered in Seychelles.

...

MEXC trade volume and market listings | CoinMarketCap

MEXC trade volume and market listings

- Messages

- 34,387

- Reaction score

- 5,828

- Points

- 288

Russian firm BitCluster to establish 120 MW Bitcoin mining center in Ethiopia

Russian Bitcoin mining solutions provider BitCluster has unveiled plans to establish a 120-megawatt (MW) data center in Ethiopia. The move aims to position Ethiopia as a key player in the global Bitcoin mining landscape.BitCluster’s initiative focuses on constructing a state-of-the-art data center spanning 30,000 square meters in Addis Ababa, the capital of Ethiopia. Located within the Kilinto high voltage substation, the facility is strategically designed to meet the demanding requirements of modern mining devices. With transformers being connected, the data center is slated to commence operations in January 2024.

More:

- Messages

- 34,387

- Reaction score

- 5,828

- Points

- 288

2024: AI-Linked Cryptocurrency Sector to Thrive with Tech Convergence

Analysts are predicting a substantial surge in the AI-related cryptocurrency sector in 2024, driven by the convergence of innovations stemming from both artificial intelligence and web3 technologies. This convergence is expected to bring about significant advancements and opportunities in the cryptocurrency space, with the potential to reshape the industry as we know it.More:

- Messages

- 34,387

- Reaction score

- 5,828

- Points

- 288

If You Gifted Your Family $100 In Bitcoin, Dogecoin And Ethereum Last Christmas, Here's How Much They Would Have This Christmas

One of the annual traditions of Christmas for most families is the giving and receiving of gifts. While popular gift items include toys, clothes, gift cards, and money, another option is to give a gift of cryptocurrency. Here's a look back at how much a gift of cryptocurrency for Christmas in...

Bitcoin Millionaire Boom: Over 90,000 Wallets Now Worth $1M Or More As Apex Crypto Surges 150% In 2023

Bitcoin (CRYPTO: BTC) shattered the key $40,000 resistance level in 2023, boasting a remarkable 150% surge and minting numerous cryptocurrency millionaires in its wake.

So this news broke a day or two ago and I did not post it here mostly because I did not understand what the ramifications are:

There seems to be a lot of speculation as to what it means, but no one (other than the folks at Tether) can say for sure.

Tether, the operator of the world’s largest stablecoin, the eponymous Tether (USDT), has minted another billion USDT, which is “authorized but not issued,” according to CEO Paolo Ardoino.

Blockchain tracking platform Whale Alert took to X (formerly Twitter) on Dec. 25 to alert users that Tether Treasury had minted 1 billion USDT ($1 billion).

Tether CEO Ardoino subsequently responded with a public service announcement in the Whale Alert’s X thread, stating that the transaction was an “inventory replenish” on the Ethereum blockchain.

“Note this is an authorized but not issued transaction, meaning that this amount will be used as inventory for next period issuance requests and chain swaps,” Ardoino stated.

In traditional finance, inventory replenishment is the process of ordering stock from suppliers in time to meet customer demand and avoid stock shortages without stockpiling surplus inventory. In Tether’s terms, inventory replenishment is the process of creating new USDT that are stored in Tether’s treasury inventory as “authorized but not issued” USDT.

“These tokens are not part of the total market capitalization of USDT, as they have not been issued or released into circulation yet,” Tether’s FAQ reads.

According to data from the Tether Transparency page, $925 million in USDT is “authorized but not issued” on Ethereum as of Dec. 26, 2023.

Ardoino’s latest PSA echoes the language of a previous 1 billion USDT mint in September 2023, when Whale Alert flagged a similar transaction. On that occasion, Ardoino also said that the USDT transaction was an authorization and not an actual issuance, with the allocated amount set to serve as inventory for upcoming issuance requests and chain swaps on the Tron network.

Some online industry watchers have expressed skepticism about Ardoino’s latest PSA and the lack of transparency associated with Tether’s authorized but not issued transactions.

“It would be interesting to examine the document or agreement and learn more about the individuals responsible for this Christmas miracle of creating 1 billion USDTs of thin air,” one commenter wrote, asking whether Ardoino is one of the individuals responsible for such decisions.

Some skeptics also argued that the latest USDT mint will likely be used to increase the price of Bitcoin (BTC), as some industry observers have linked Tether’s USDT minting to BTC price pumping.

“Say it directly you minted it to pump BTC,” one commenter responded in the thread.

...

There seems to be a lot of speculation as to what it means, but no one (other than the folks at Tether) can say for sure.

MicroStrategy (MSTR), the largest corporate holder of bitcoin (BTC), added more to its holdings on Wednesday, buying 14,620 BTC for around $615.7 million.

...

The recent purchase pushes the company's holdings to 189,150 BTC worth around $5.9 billion, which was bought at an average price of $31,168 per BTC.

MicroStrategy began purchasing bitcoin in August 2020. The company's most recent purchase before Wednesday's took place last month, where it purchased 16,130 BTC, worth around $608 million at the time.

In a separate filing, the company said it had raised $610.1 million from its previously announced at-the-market (ATM) shares offering of $750 million.

...

MicroStrategy Buys $615M Worth Additional BTC, Pushing Holdings to $5.9B

MicroStrategy's used almost all of its recent at-the-market shares sales to buy an additional 14,620 bitcoin.

As I understand it, some institutional players are buying MicroStrategy stock as a play on Bitcoin (instead of buying Bitcoin directly with all the attendant custody issues). I wonder how the availability of spot ETFs is going to affect MicroStrategy stock.

For context, Bitcoin market cap is $842.8B at the moment according to coinmarketcap.com

- Messages

- 34,387

- Reaction score

- 5,828

- Points

- 288

From the link:

This year has seen the rise of cryptocurrency’s most heinous criminals. The cryptocurrency’s ‘villains’ have done all in their power to tarnish the crypto industry’s reputation.

These crypto villains are bad news for blockchain‘s growth, whether in court, on social media, or even from a secret North Korean bunker.

Who are the masterminds behind the most devious schemes in the crypto realm? Which nefarious characters have outsmarted the smart contracts, leaving a trail of digital mayhem in their wake?

www.cryptopolitan.com

www.cryptopolitan.com

This year has seen the rise of cryptocurrency’s most heinous criminals. The cryptocurrency’s ‘villains’ have done all in their power to tarnish the crypto industry’s reputation.

These crypto villains are bad news for blockchain‘s growth, whether in court, on social media, or even from a secret North Korean bunker.

Who are the masterminds behind the most devious schemes in the crypto realm? Which nefarious characters have outsmarted the smart contracts, leaving a trail of digital mayhem in their wake?

The 2023 award for top crypto villain goes to the following

A "Crypto Villain" is not your typical nemesis; 2023's top villains are 2022's crypto heroes who appeared to propel the industry forward. But it was all a front.

www.cryptopolitan.com

www.cryptopolitan.com

FWIW:

www.coindesk.com

www.coindesk.com

I'm not sure I buy a correction to 32K, but BTC is quite volatile, so who knows. Maybe it dips to 32 again before exploding higher. In any event, I HODL (hold on for dear life) my BTC just like with my physical gold and silver.

Bitcoin (BTC) is expected to correct to as low as $32,000 next month following the potential approval of a spot ETF, according to data provider CryptoQuant.

In what is being described as a potential "sell the news" event, CryptoQuant said in a note to CoinDesk that trader's unrealized profits are currently lingering at a level that historically precedes a correction.

...

"Short term Bitcoin holders are experiencing high unrealized profit margins of 30%, which historically has preceded price corrections (red circles)," CryptoQuant wrote in the note. "Moreover, short term holders are still spending Bitcoin at a profit, while rallies usually come after short-term losses are realized."

CryptoQuant added that bitcoin price may decline to as low as $32,000, which is the the short-term holder realized price.

Capriole Investments said that "conservative portfolio management" makes sense in the lead up to the potential approval of a spot ETF.

"With Bitcoin up over 60% since ETF mania began a few months ago, and with every man and his dog on X.com expecting an approval on or around 10 January, we must start to anticipate much larger volatility events (up/down) in this region. Risk today is substantially higher for long Bitcoin positions than it was just a few weeks ago," Capriole wrote in a blog post.

...

Bitcoin ETF Approval Tipped to Be 'Sell The News' Event: CryptoQuant

Bitcoin could fall to as low as $32,000 next month if an ETF is approved.

I'm not sure I buy a correction to 32K, but BTC is quite volatile, so who knows. Maybe it dips to 32 again before exploding higher. In any event, I HODL (hold on for dear life) my BTC just like with my physical gold and silver.

More immediately:

More:

...

On Friday at 08:00 UTC, a staggering $7.7 billion worth of options tied to bitcoin (BTC) and $3.5 billion of options linked to ether (ETH) will expire on the crypto exchange Deribit.

"The total of over $11 billion marks Deribit's largest expiry thus far, of which almost $5 billion will expire in the money, the largest amount ever as well, potentially resulting in above average hedging and trading activity," Luuk Strijers, the exchange's chief commercial officer, told CoinDesk.

...

More:

...

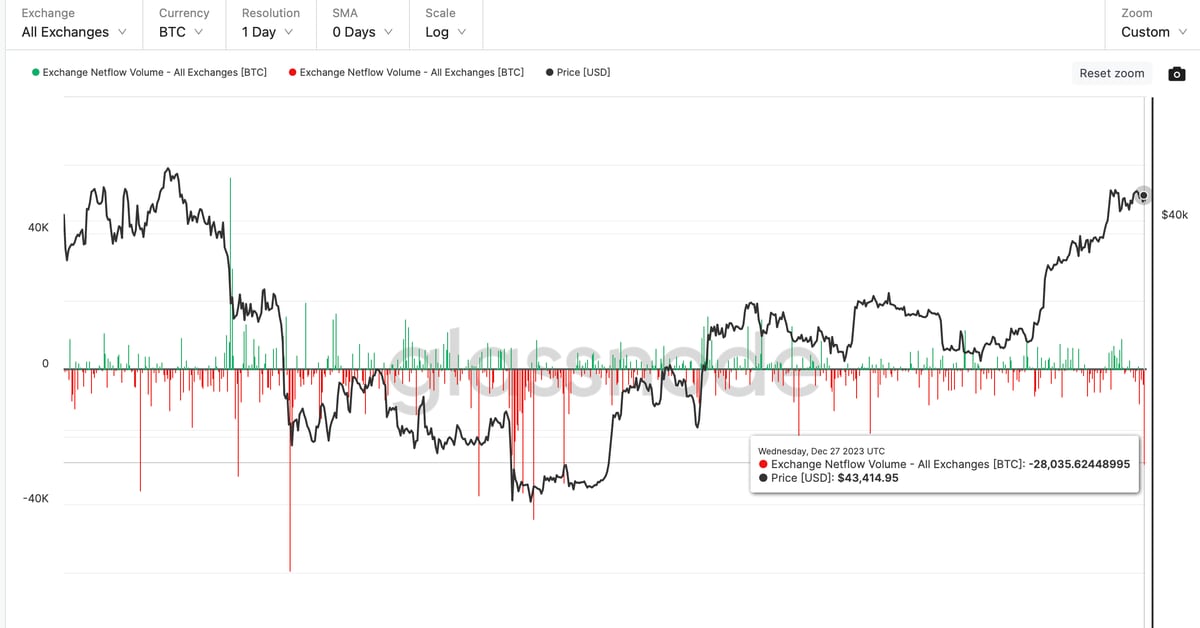

On Wednesday, just over 28,000 BTC worth $1.19 billion left centralized exchanges, the largest single-day outflow in BTC terms since Dec. 14, 2022, according to data tracked by blockchain analytics firm Glassnode.

Net outflows from exchanges are often taken to represent investors' intention to take direct custody of coins or preference for a long-term holding strategy.

...

The overall BTC balance in wallets tied to centralized exchanges has dropped to 2,327,025 BTC, the lowest since April 2018. Other things being equal, fewer coins on an exchange mean weakening supply-side pressures and potential for price appreciation.

...

Bitcoin Worth $1B Leaves Exchanges in Largest Single-Day Outflow in 12 Months

Net outflows from exchanges are often taken to represent investors' intention to hold coins for long-term.

Looks to me like volatility is going to pick up as we approach Jan 10 (SEC ETF decision).

...

The U.S. Securities and Exchange Commission said last week that spot Bitcoin ETF applicants must file final S-1 amendments by Dec. 29. The regulator also required them to sign an agreement with an authorized participant (AP) and sort out the cash-create redemption model it favors.

The deadline means that on Dec. 29, the community will likely find out which spot Bitcoin ETF filers out of 14 applicants could be in the first wave of potential spot BTC ETF approvals, which is largely expected in early January.

According to Bloomberg senior ETF analyst Eric Balchunas, many ETF applicants have updated their filings with the cash-create redemption model. As of Dec. 22, seven applicants had their filings fixed to cash-create, while the other seven included both cash-create and in-kind models in their registration statements.

Most existing ETFs involve in-kind creation, meaning that when the intermediaries want to make new ETF shares, they give firms like BlackRock funds using actual assets like Bitcoin.

“And that’s how 90% of ETFs work is in-kind. Only 10% are cash,” Balchunas said in an interview with Cointelegraph on Dec. 28.

The reason the SEC wants the cash model for spot Bitcoin ETFs is that they want to minimize the number of intermediaries that have access to the actual Bitcoin in the redemption and offering process, the ETF analyst believes.

“They don’t like the idea of broker-dealers who are the intermediaries touching Bitcoin,” Balchunas noted. “Many were going to create unregistered subsidiaries to act in place of the actual broker-dealers, but the SEC just didn’t want it,” the ETF analyst said.

The SEC wanted to “close the loop a little more,” Balchunas said, ...

More:

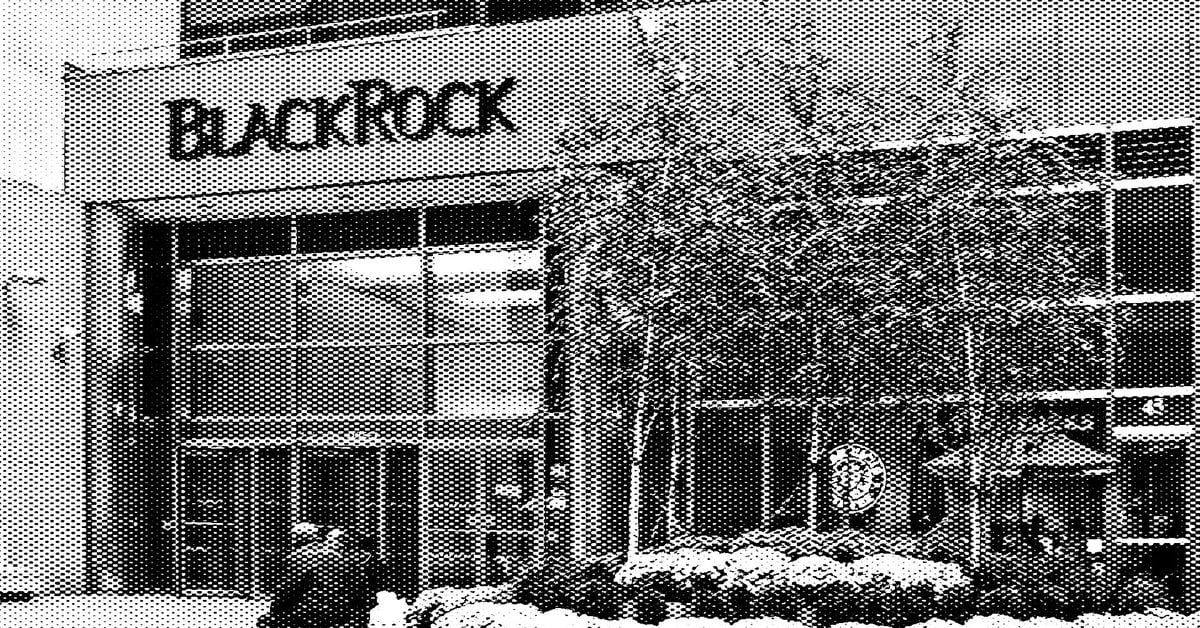

Two spot bitcoin exchange-traded fund (ETF) applicants, BlackRock and Valkyrie, have named two authorized participants (AP) for their yet-to-be-approved ETF, filings show.

BlackRock was the first applicant to announce who will acquire the bitcoin on behalf of BlackRock, which is not legally allowed to purchase the cryptocurrency itself. The asset manager has teamed up with J.P. Morgan and quantitative trading firm Jane Street, a filing shows. Valkyrie has also named Jane Street in addition to Cantor Fitzgerald as AP, another filing shows. Many ETF issuers will likely have multiple authorized participants.

...

BlackRock, Valkyrie Name Authorized Participants Including JPMorgan for Bitcoin ETF

BlackRock will use J.P. Morgan and Jane Street as their authorized participants. Valkyrie has also named Jane Street in addition to Cantor Fitzgerald.

- Messages

- 18,277

- Reaction score

- 11,006

- Points

- 288

"BlackRock is About to Unleash An Tsunami On Bitcoin" Will Clemente Bitcoin 2024 Prediction

On-Chain Bitcoin analyst Will Clemente believes that this current moment on the eve of the Bitcoin ETFs, is the biggest moment in Bitcoins history.An approved Bitcoin ETF is the biggest milestone for Bitcoin for a variety of reasons:

1st off, it’s a stamp of approval for Bitcoin from the SEC which is essentially a stamp of approval by the U.S Government.

2nd off - it’s going to unlock passive flows & a tsunami of capital from sophisticated and isntitutional investors who weren’t able to invest in Bitcoin before.

3rd and finally, its going to cause a marketing blitz for Bitcoin, as institutions such as BlackRock, Fidelity & Grayscale fight over supremacy of the top Bitcoin ETF.

They are all going to launch marketing campaigns to attract investors to their ETF.

Make sure to stick around to the end of the video where Will Clemente speaks on why Bitcoin fixes wealth inequality caused by Monetary debasement and why not just Bitcoin, but the entire crypto space is going to rise.

About Will Clemente: Will Clemente is the co-founder of Reflexivity Research which is a research firm with the mission of providing crypto native research for non-crypto natives. Will also has a large Twitter following of 700,000 where he shares his thoughts on Bitcoin and markets.

11m

Predictions for Bitcoin in 2024 vary wildly, but even the most bearish calls for a 50% rise:

www.cnbc.com

www.cnbc.com

These are the boldest bitcoin predictions for 2024 — one calls for a 1,000% rally to $500,000

Commentators CNBC spoke to, both inside and outside of the cryptocurrency industry, have given various bitcoin price predictions for bitcoin in 2024.

- Messages

- 34,387

- Reaction score

- 5,828

- Points

- 288

Bitcoin climbs above $45,000 for first time since April 2022

- After 156% gain in 2023, bitcoin starts new year on front foot

- Optimism around ETF approval gathering momentum

- Rising bets on rate cuts also boost risk appetite

Bitcoin touched a 21-month peak of $45,532, having gained 156% last year in its strongest yearly performance since 2020. It was last up 3.5% at $45,727 but remains far off the record high of $69,000 it hit in November 2021.

More:

- Messages

- 34,387

- Reaction score

- 5,828

- Points

- 288

Bitcoin-Related Companies Show Pre-Market Gains as BTC Nears $46K

U.S.-listed companies rode bitcoin's bullish momentum to show significant gains in pre-market trading, including COIN, MSTR, MARA and RIOT.

spinalcracker

Ground Beetle

- Messages

- 566

- Reaction score

- 999

- Points

- 278

Yeah Baby!

to the moon in 2024!

it’s not to,

late to get on board , the train is still at the station..

Commentators CNBC spoke to, both inside and outside of the cryptocurrency industry, have given various price predictions for bitcoin in 2024, ranging from $60,000 to $500,000.

to the moon in 2024!

it’s not to,

late to get on board , the train is still at the station..

Commentators CNBC spoke to, both inside and outside of the cryptocurrency industry, have given various price predictions for bitcoin in 2024, ranging from $60,000 to $500,000.

Of course it will be approved. It WILL be used to manipulate and control Bitcoin... Just like all the other commodity ETF's.

So you shouldn't be a fan if you actually are bullish Bitcoin.

The two "authorized" participants... JPM and Virtu Financial The two biggest cons on the planet.

So you shouldn't be a fan if you actually are bullish Bitcoin.

The two "authorized" participants... JPM and Virtu Financial The two biggest cons on the planet.

- Messages

- 34,387

- Reaction score

- 5,828

- Points

- 288

2024 IRS Tax Reporting Rule on Crypto Transactions Above $10K Sparks Controversy

The Internal Revenue Service (IRS) now requires anyone who receives at least $10,000 in cryptocurrencies to report transaction information to the IRS.

Bitcoin slid 8% on Wednesday as jitters around the anticipated approval of a spot bitcon (BTC) ETF began to enter the market.

...

Financial services firm Matrixport rebuffed optimistic expectations, saying: "We believe all applications fall short of a critical requirement that must be met before the SEC approves. This might be fulfilled by Q2 2024, but we expect the SEC to reject all proposals in January."

...

Bitcoin Slumps as $400M Liquidated in Two Hours

Financial services company Matrixport said it expects the SEC to reject all ETFs applications this month.

Tweets moving markets.

...

Bloomberg ETF analyst Eric Balchunas said during U.S. afternoon hours that the agency was providing final comments on the applications, with prospective issuers then to update their filings accordingly.

Shortly after, TechCrunch reporter Jacquelyn Melinek said that the SEC will soon approve multiple applications, citing sources "extremely close to the matter."

...

Bitcoin Rebounds Above $44K as Spot BTC ETF Approval Looks Increasingly Likely

Reports swirled Thursday that the SEC was giving final comments to issuers and may approve multiple spot-based bitcoin ETF applications very soon.

US Government is a huge BTC whale.

coingape.com

coingape.com

U.S. Government's Bitcoin Holdings Surge to $8.3 Billion, Outpaces MicroStrategy

US govt's Bitcoin stash hits $8.3B, overtaking corporations and other nations, as crypto market anticipates potential Silk Road BTC sales.

coingape.com

coingape.com

Rumor:

Wednesday is the 10th. It's the deadline day for the SEC decision on ARK's application. Some say the SEC could rule as early as Monday. Some say they will rule on multiple applications at once (Blackrock et al have deadlines in June, but could be included when SEC decides on ARK's application).

Wednesday is the 10th. It's the deadline day for the SEC decision on ARK's application. Some say the SEC could rule as early as Monday. Some say they will rule on multiple applications at once (Blackrock et al have deadlines in June, but could be included when SEC decides on ARK's application).

Last edited:

BlackRock (BLK), VanEck, Invesco and Galaxy, ARK 21Shares, Grayscale and other prospective issuers among 13 hoping to launch bitcoin (BTC) exchange-traded funds (ETFs) in the U.S., have filed updated documents on Tuesday.

The filings indicate that the entities were among the prospective issuers that the U.S. Securities and Exchange Commission (SEC) sent comments in the past 24 hours. CoinDesk reported earlier that the SEC sent comments to a set of prospective issuers of the spot-bitcoin ETFs just hours after the companies filed documents detailing fees for their proposed products on Monday.

Among the changes in the latest updated filing on Tuesday is wording that seeks to mitigate damage to shareholders in the event of insolvency and avoid a conflict of interest between the ETF’s authorized participants.

Invesco and Galaxy's updated filing saw them reduce the fee they plan to charge to 0.39% from the earlier 0.59%.

The latest filings show an almost unprecedented engagement between the SEC and prospective issuers, with filings following SEC responses and then updated filings within a short span of 24 hours.

The SEC is widely expected to approve all the applications this week as it faces a Jan. 10, 2024 deadline – i.e. this Wednesday – for one of the applications by Ark and 21 Shares and may want to approve all together in the spirit of fairness.

BlackRock, VanEck and Others Update Bitcoin ETF Filing Within Hours of Quick SEC Response

The filings indicate that the two entities were among the prospective issuers that the U.S. Securities and Exchange Commission (SEC) sent comments in the past 24 hours.

Crypto is going to explode tomorrow when the SEC approves the ETFs.

Get the moneychangers into the crypto world.

Short-term, a gain.

Long-term, it's just going to turn it into the same swamp of deceit that central-bank fiat is in, now.

Short-term, a gain.

Long-term, it's just going to turn it into the same swamp of deceit that central-bank fiat is in, now.

SEC twitter today:

Wi not trei a holiday in Sweeden this yer ?

See the loveli lakes

The wonderful telephone system

And mani interesting furry animals

Including the majestic moose

A moose once bit my sister...

Wi not trei a holiday in Sweeden this yer ?

See the loveli lakes

The wonderful telephone system

And mani interesting furry animals

Including the majestic moose

A moose once bit my sister...

- Messages

- 34,387

- Reaction score

- 5,828

- Points

- 288

Crypto Boosters Attack SEC for 'Manipulating' BTC Market After ETF Tweet

Lawmakers and crypto boosters are asking questions about how the SEC's X (formerly Twitter) account was compromised, leading to a bogus tweet on Tuesday.

I saw several Congress critters on X calling for investigation into the SEC ETF tweetgate including Senator Lummis. The SEC is "going to investigate itself."

I wonder how many of Gensler's Vampire Squid buddies made some easy money on that bullshit.

I wonder how many of Gensler's Vampire Squid buddies made some easy money on that bullshit.

- Status

- Not open for further replies.