- Messages

- 36,925

- Reaction score

- 6,348

- Points

- 288

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

That'll solve the problem, awright. What, precisely, do these assholes get paid for doing???

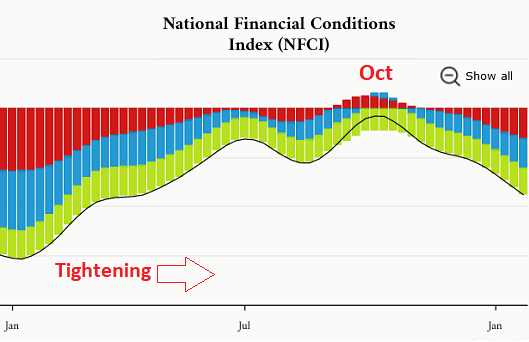

Investors now expect the major central banks to raise rates much more than they were just at the start of this month. They are still underpricing the risk of how much more tightening is to come.

The Federal Reserve may raise interest rates as high as 6%, the European Central Bank to 4% and the Bank of England to possibly 5% should the global economy continue to be resilient and inflation run rife.

Here’s why...

St. Louis Federal Reserve President James Bullard expressed confidence that the central bank can beat inflation and advocated Wednesday for stepping up the pace in the battle.

Bullard told CNBC that a more aggressive interest rate hike now would give the rate-setting Federal Open Market Committee a better chance to bring down inflation that, while falling some off the precarious levels of 2022, is still high.

...

Those comments come a week after Bullard and Cleveland Fed President Loretta Mester both said they were pushing for a half percentage point rate hike at the last meeting, rather than the quarter-point move the FOMC ultimately approved.

They said they would continue to favor a more aggressive move at the March meeting. ...

...

A "few" members said they wanted a half-point, or 50 basis points, hike that would show even greater resolve to get inflation down.

Since the meeting, regional presidents James Bullard of St. Louis and Loretta Mester of Cleveland have said they were among the group that wanted the more aggressive move. The minutes, however did not elaborate on how many a "few" were nor which Federal Open Market Committee members wanted the half-point increase.

...

Fed Minutes released - no real new info.

They should just cut to the chase and raise by 100 next time.A "few" members said they wanted a half-point, or 50 basis points, hike that would show even greater resolve to get inflation down.

Fed minutes show members resolved to keep fighting inflation with rate hikes

While the meeting ended with a smaller rate hike than most of those implemented since early 2022, officials stressed that their concern over inflation is high.www.cnbc.com

The secret to stocks’ success so far in 2023? An unexpected $1 trillion liquidity boost by central banks. ( behind paywall - but you get the idea.)They are trying to choke inflation without completely imploding the economy. I expect they will raise rates by 50 next time unless economic data gives them solid assurance that disinflation has taken root, but we aren't there yet.

It seemed like only yesterday that markets were sure that a tougher Federal Reserve was going to raise its benchmark interest rate a half percentage point at its meeting in less than two weeks.

That's because it, in fact, was yesterday. On Thursday, traders in the futures market were almost certain the Fed would take a more hawkish monetary policy stance and double up on the quarter-point hike it approved last month.

But one bank implosion and a cooperative jobs report later, and the market has changed its mind.

...

...

Onto our call of the day from Goldman Sachs, where economists say the rescue of SVB and other depositors will tie the Fed’s hands next week.

“In light of recent stress in the banking system, we no longer expect the FOMC to deliver a rate hike at its March 22 meeting with considerable uncertainty about the path beyond March,” said a team led by chief economist Jan Hatzius in a note to clients late Sunday.

...

...

But the Fed also has to provide its forecast of the future path of interest rate hikes and these might be hard for the market to digest.

“The risk is…the associated ‘dot plot’ will be a little hawkish,” said Vince Reinhart, chief economist at Dreyfus and Mellon,

That’s because the Fed’s forecast will likely show a stark difference from the market’s views.

The Fed’s so called dot-plot will likely stick to its forecast endpoint of rates at 5.1%, which implies one more rate hike in May, but it could raise the endpoint to 5.375%.

In either case, the Fed is not expected to forecast any rate cuts this year.

The market is barely pricing in a May hike but then the differences set in. Market pricing implies a rate cut as soon as June, with rates falling to 4.25%-4.5% by year end.

Economists don’t think the market will be convinced.

...

That was the safe move. Had they went .5, it would have signaled that they were wrong in only doing .25 last time..25 today.

Interesting that the fed is raising rates and increasing it's balance sheet at the same time, is this a first?

Look at the change from march 8 to the 15th up over a 140 billion.Balance sheet exploded because of bank rescue efforts. It wasn't a planned or desired action. Of course, that doesn't mean that more unplanned and undesired balance sheet expansion is impossible (or improbable).

Look at the change from march 8 to the 15th up over a 140 billion.

Tomorrow some more balance sheet info comes out I just find it hilarious that the fed is pretend tightening at the present time.

Pretend and extend, isn't that the Fed's motto?Tomorrow some more balance sheet info comes out I just find it hilarious that the fed is pretend tightening at the present time.