swissaustrian

Yellow Jacket

- Messages

- 2,049

- Reaction score

- 0

- Points

- 156

BOTF = bet on the FEDSo what you are saying is... BTFD

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

BOTF = bet on the FEDSo what you are saying is... BTFD

The Federal Reserve Bank of New York said it’s temporarily adding reserves to the banking system with “small-value” repurchase agreements ...

... All eligible collateral will be able to be used in the transactions, which will be conducted with the central bank’s 21 primary dealers.

In June 2012, the Federal Open Market Committee authorized the New York Fed to undertake repos and outright purchases and sales of securities, in addition to reverse repos, for testing. The Fed did its first round of repo testing in August 2012.

...

In repos, the Fed buys U.S. Treasury, mortgage-backed and so-called agency debt from dealers for a set period, temporarily raising the amount of money available in the banking system. At maturity, the securities are returned to the dealers, and the cash to the Fed.

Art Cashin said:... the Federal Reserve Bank of St. Louis puts out what is called the ‘Monetary Stock.’ It is the ‘raw material’ of the money supply, and it has been dormant throughout the year.

The report for the first part of this year suddenly spiked higher, and it’s something that I’m going to keep a very close look at. It may be, and there is some seasonality, but I think people need to begin watching the money supply, particularly the M2, and see if that starts to accelerate.

...

Ambrose Evans-Pritchard said:Officials at the US Federal Reserve may be more worried than they have let on about the treacherous task of extricating America from quantitative easing. This is an unsettling twist, with global implications.

A new paper for the US Monetary Policy Forum and published by the Fed warns that the institution's capital base could be wiped out "several times" once borrowing costs start to rise in earnest.

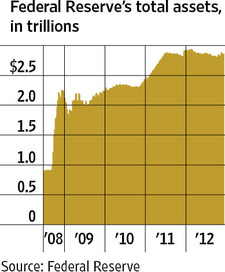

A mere whiff of inflation or more likely stagflation would cause a bond market rout, leaving the Fed nursing escalating losses on its $2.9 trillion holdings. This portfolio is rising by $85 billion each month under QE3. The longer it goes on, the greater the risk. Exit will become much harder by 2014.

Such losses would lead to a political storm on Capitol Hill and risk a crisis of confidence. The paper -- "Crunch Time: Fiscal Crises and the Role of Monetary Policy" -- is co-written by former Fed governor Frederic Mishkin, Ben Bernanke's former right-hand man:

http://research.chicagobooth.edu/igm/usmpf/download2.aspx

It argues the Fed is acutely vulnerable because it has stretched the average maturity of its bond holdings to 11 years, and the longer the date, the bigger the losses when yields rise. The Bank of Japan has kept below three years.

Trouble could start by mid-decade and then compound at an alarming pace, with yields spiking up to double-digit rates by the late 2020s. By then Fed will be forced to finance spending to avert the greater evil of default.

"Sovereign risk remains alive and well in the U.S, and could intensify. Feedback effects of higher rates can lead to a more dramatic deterioration in long-run debt sustainability in the US than is captured in official estimates," it said.

Europe has its own "QE" travails. The paper said the ECB's purchase of Club Med bond amounts to "monetisation" of public debt in countries shut out of global markets, whatever the claims of Mario Draghi.

"We see at least a risk that the eurozone is on a path to become more like Argentina (which of course is why German central bankers are most concerned). The provinces overspend and are always bailed out by the central government. The result is a permanent fiscal imbalance for the central government, which then results in monetization of the debt by the central bank and high inflation," it said.

In America, the Fed would face huge pressure to hold onto its bonds rather than crystalize losses as yields rise -- in other words, to recoil from unwinding QE at the proper moment. The authors argue that it would be tantamount to throwing in the towel on inflation, the start of debt monetisation, or "fiscal dominance." Markets would be merciless. Bond vigilantes would soon price in a very different world.

Investors have of course been fretting about this for some time. Scott Minerd from Guggenheim Partners thinks the Fed is already trapped and may have to talk up gold to $10,000 an ounce to ensure that its own bullion reserves cover mounting liabilities.

...

...

I'm still trying to wrap my head around the fact that AEP is publicizing this.

Readers of the Daily Telegraph were right all along. Quantitative easing will never be reversed. It is not liquidity management as claimed so vehemently at the outset. It really is the same as printing money.

Columbia Professor Michael Woodford, the world's most closely followed monetary theorist, says it is time to come clean and state openly that bond purchases are forever, and the sooner people understand this the better.

"All this talk of exit strategies is deeply negative," he told a London Business School seminar on the merits of helicopter money, or "overt monetary financing."

He said the Bank of Japan made the mistake of reversing all its money creation from 2001 to 2006 once it thought the economy was safely out of the woods. But Japan crashed back into deeper deflation as soon the Lehman crisis hit.

"If we are going to scare the horses, let's scare them properly. Let's go further and eliminate government debt on the bloated balance sheet of central banks," he said. This could done with a flick of the fingers. The debt would vanish.

Lord Turner, head of the now defunct Financial Services Authority, made the point more delicately. "We must tell people that, if necessary, QE will turn out to be permanent."

The write-off should cover "previous fiscal deficits," the stock of public debt. It should be "post-facto monetary finance."

The policy is elastic, for Lord Turner went on to argue that central banks in the US, Japan, and Europe should stand ready to finance current spending as well, if push comes to shove. At least the money would go straight into the veins of the economy rather than leaking out into asset bubbles.

Today's QE relies on pushing down borrowing costs. It is "creditism." That is a very blunt tool in a deleveraging bust when nobody wants to borrow.

Lord Turner says the current policy has become dangerous, yielding ever-less returns, with ever-worsening side-effects. It would be better for central banks to put the money into railways, bridges, clean energy, smart grids, or whatever does most to regenerate the economy.

The policy can be "wrapped" in such a way as to preserve central bank independence. The Fed or the Bank of England would decide when enough is enough, or what the proper pace should be, just as they calibrate every tool. That at least is the argument. I merely report it.

Lord Turner knows this breaks the ultimate taboo, and that taboos evolve for sound anthropological reasons, but he invokes the doctrine of the lesser evil. "The danger in this environment is that if we deny ourselves this option, people will find other ways of dealing with deflation, and that would be worse."

A breakdown of the global trading system might be one, armed conquest or Fascism may be others -- or all together, as in the 1930s.

...

If Lord Turner's helicopters are ever needed, we can be sure that the Anglo-Saxons and the Japanese will steal a march while Europe will be the last to move. The European Central Bank will resist monetary financing of deficits until the bitter end, knowing that such action risks destroying German political consent for the euro project.

By holding the line on orthodoxy, the ECB will guarantee that Euroland continues to suffer the deepest depression. Once the dirty game begins, you stand aside at your peril.

A great many readers in Britain and the US will be horrified that this helicopter debate is taking place at all, as if the QE virus is mutating into ever-more deadly strains.

Bondholders across the world may suspect that Britain, the US, and other deadbeat states are engineering a stealth default on sovereign debts, and they may be right in a sense. But they are warned. This is the next shoe to drop in the temples of central banking.

Jim Rickards said:#ECB rates unch. This is a problem for #Bernanke. He wants #US #Japan #UK & #Euro to hold hands, jump off cliff together. #Euro won't play.

...

At today’s meeting the Governing Council of the ECB decided that the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged ...

Jim Reid said:The move by the BoJ plays into our 'Journey into the Unknown' thesis and its fair to say that there really is no precedent for what Central Banks are currently doing, or threatening to do, on a global scale. You'll be able to read chapter and verse from strategists trying to explain what's likely to result from such moves but the honest truth is that we are flying blind in terms of historical evidence even if we go back centuries. My guess is that medium-term global inflation is being locked in by these moves but that the first move is likely to be maintaining the low bond yield world for some time even if there are brief selloffs. For riskier assets, our simple models based on variables like the PMIs tell us that we may be due a set back soon. These models survived the liquidity burst of QE1 and QE2 but will they now be overpowered by the combined OMT potential, QE-infinity and the BoJ's new 'Carry-O-QE' (ok I know it won't catch on)? Our base case remains that we will eventually see a set back as we approach the end of H1 on weaker data (especially in Europe) but that outside of a shock, the downside will be perhaps limited by global Central Bank liquidity. Fascinating times and we can't help thinking that these moves are not without consequence. If it really is as easy as printing money then all Central Bank's would have done it a long time ago. That such a period for global CB's is unprecedented should serve as a warning to watch for unintended consequences.

AEP said:...

My view is that the US Federal Reserve and the Bank of Japan "caused" the gold crash. The rest is noise. The Fed assault began in February when it published a paper warning that the longer quantitative easing continues, the harder it will be for the bank to extricate itself.

The report was co-written by former Fed governor Frederic Mishkin, often deemed Ben Bernanke's "alter ego". It said the Fed's capital base could be wiped out "several times" once borrowing costs climb. The window will start shutting by 2014, with trouble then compounding at a "dramatic" pace.

This was a shock. It suggested that the Fed has lost its nerve, and will think long and hard before launching a fresh blitz of money if growth falters.

Then came last week's Fed Minutes, with hints of tapering off QE earlier that expected. That was the next shock. What they seemed to be saying is that the US economy is groping it way back to normality, that the era of silly money is over, that the dollar will stand tall again.

If that were the case, gold should fall. But it is not the case. The US economy is growing below the Fed's own "stall speed" indicator. Half a million people fell out of the workforce in March. Retail sales fell in March. So did manufacturing.

The US faces fiscal tightening of 2.5pc of GDP this year, the most since 1946. Ex-labour secretary Robert Reich said the effects have been disguised so far, but a "stealth sequester" is just starting: $51m of grant cuts to Brandeis university; $1m for schools in Syracuse; and so on, the reverse of the stealth stimulus before.

My guess is that the Fed will be forced to row back smartly from its exit talk, but first we must look deflation in the eyes.

...

Three regional Federal Reserve bank presidents said a further decline in U.S. inflation below the Fed’s 2 percent goal may signal a need for more accommodation.

“If inflation looked like it was going to sag further on a persistent basis, I would certainly consider stimulus for the purpose of bringing inflation up to target,” Richmond Fed President Jeffrey Lacker said today, adding he doesn’t see an imminent disinflation risk. Minneapolis Fed President Narayana Kocherlakota today called for guarding the inflation target “from below,” while James Bullard of St. Louis said yesterday, “we should defend the inflation target from the low side.”

...

#Fed Presidents say need more ease ... Last week Fed members said less ease. These guys have no idea what they’re doing.

Jim Rickards said:#Fed Presidents say need more ease ... Last week Fed members said less ease. These guys have no idea what they’re doing.

http://www.cnbc.com/id/100650518Central Bankers Say They Are Flying Blind

rowing concern at the International Monetary Fund over the long-term side-effects of interest rates close to zero came as some of the leading figures in central banking conceded they were flying blind when steering their economies.

Lorenzo Bini Smaghi, the former member of the European Central Bank's executive board, captured the mood at the IMF's spring meeting, saying: "We don't fully understand what is happening in advanced economies." ...

This guy's graphs on the "QE Trap" are excellent:

http://finance.yahoo.com/news/richard-koo-cant-anyone-refute-125046383.html

"The QE "trap" happens when the central bank has purchased long-term government bonds as part of quantitative easing. Initially, long-term interest rates fall much more than they would in a country without such a policy, which means the subsequent economic recovery comes sooner (t1). But as the economy picks up, long-term rates rise sharply as local bond market participants fear the central bank will have to mop up all the excess reserves by unloading its holdings of long-term bonds.

Demand then falls in interest rate sensitive sectors such as automobiles and housing, causing the economy to slow and forcing the central bank to relax its policy stance. The economy heads towards recovery again, but as market participants refocus on the possibility of the central bank absorbing excess reserves, long-term rates surge in a repetitive cycle I have dubbed the QE "trap."

A very good analysis. We also have two other forces interfering with the recovery. The first is the negative effect on the unemployment rate that was caused by extending unemployment benefits out to almost 2 years. Studies show that long term unemployed have a much harder time rejoining the work force. They also found that if you keep giving people unemployment, many of them will take the check, and stop looking for work (I know several people who did this exact same thing). So the policy works against having a quicker recovery. The second is Obamacare. Everyone I know with private insurance just had their insurance premiums double. This is going to be another major drag rippling through the economy.

So the fed is trapped. There is no exit and no escape. Ultimately it will lead to the end of the dollar as a reserve currency and increased inflation. The odds favor that the Fed will actually increase QE spending. We might even see negative interest rates for awhile before the whole thing unravels. There doesn't appear to be any other alternatives on the horizon. $.02

...

Where are we today? The Fed keeps buying roughly $85 billion in bonds a month, chronically delaying so much as a minor QE taper. Over five years, its bond purchases have come to more than $4 trillion. Amazingly, in a supposedly free-market nation, QE has become the largest financial-markets intervention by any government in world history.

And the impact? Even by the Fed's sunniest calculations, aggressive QE over five years has generated only a few percentage points of U.S. growth. By contrast, experts outside the Fed, such as Mohammed El Erian at the Pimco investment firm, suggest that the Fed may have created and spent over $4 trillion for a total return of as little as 0.25% of GDP (i.e., a mere $40 billion bump in U.S. economic output). Both of those estimates indicate that QE isn't really working.

Unless you're Wall Street. Having racked up hundreds of billions of dollars in opaque Fed subsidies, U.S. banks have seen their collective stock price triple since March 2009. The biggest ones have only become more of a cartel: 0.2% of them now control more than 70% of the U.S. bank assets.

...

By Andrew Huszar, also posted at the WSJ. Mr. Huszar, a senior fellow at Rutgers Business School, is a former Morgan Stanley managing director. In 2009-10, he managed the Federal Reserve's $1.25 trillion agency mortgage-backed security purchase program.

Pity the writer is anonymous .........

It would have a lot more impact if we could be sure it was written by someone working at the highest level at the Fed.

... in a new paper entitled “Let’s Talk About It: What Policy Tools Should The Fed ‘Normally’ Use?”, the Boston Fed is now suggesting that QE become a permanent tool at the disposal of the Fed. After all, “financial stability” depends on it…