...

Adamas forecasts an under-supply of neodymium, praseodymium and dysprosium oxide from 2022 onward. Global shortages of NdFeB alloy and powder will amount to 48,000 tonnes annually by 2030 – roughly the amount needed for some 25 to 30 million electric vehicle traction motors.

Also neodymium, praseodymium and didymium oxide demand will collectively rise to 16,000 tonnes in 2030, an amount equal to roughly three-times Lynas Corporation’s annual output, or three-times MP Materials’ annual output, of neodymium and praseodymium oxide (or oxide equivalents).

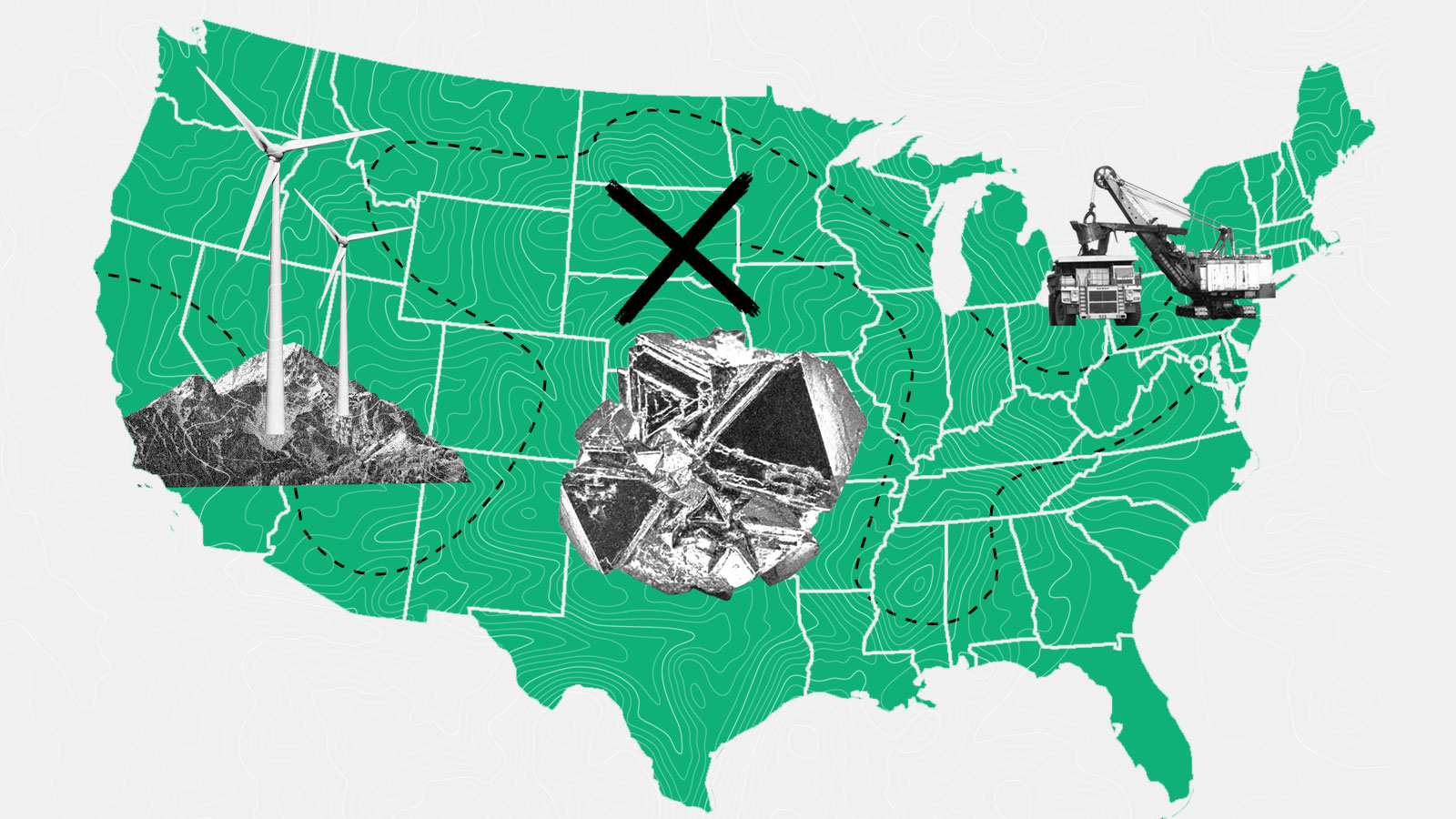

'Simply implausible' for rare earths production to keep up, warns Adamas

A roundup of all the mining news in the precious metals sector with a variety of company news, mining sector analysis, newsletter writer insights and executive interviews.

www.kitco.com

I wonder how much their forecast relies upon a growth in the electric vehicle market. Growth forecasts for that market might be questionable given current conditions (pandemic, economic stress, political uncertainty, etc.).