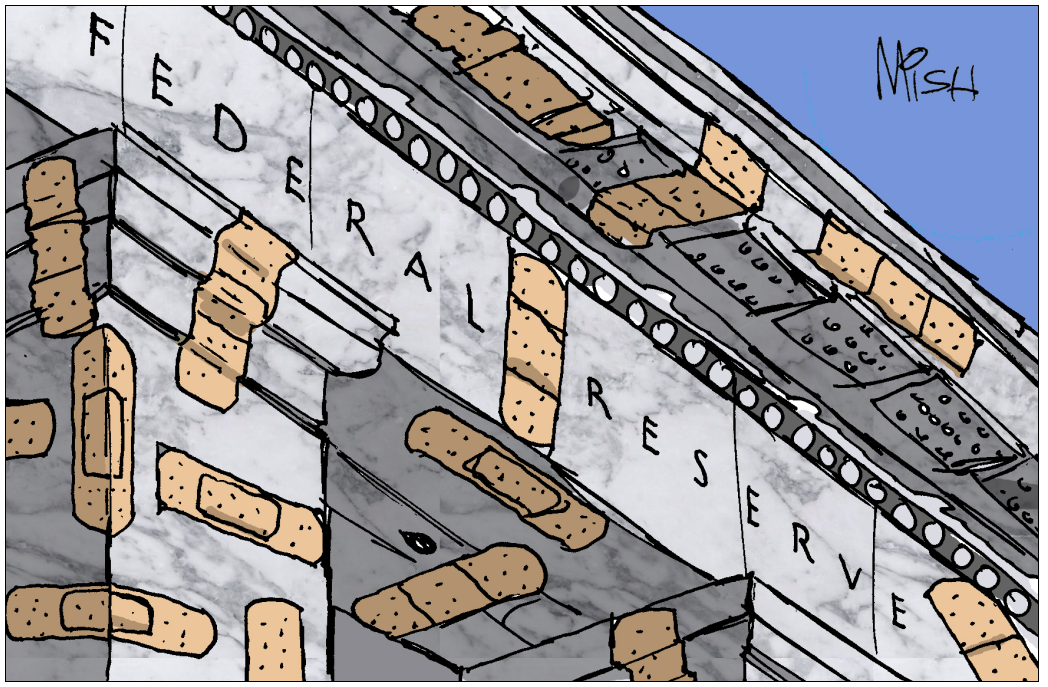

Since the inception of the Federal Reserve System, our fractional reserve banking system has steadily degraded reserve ratio requirements until they finally just did away with them altogether and ushered in our brave new era of zero reserve banking. Banks are not tasked with maintaining any specific thresholds of reserves and now manage liquidity by buying and selling debt instruments as necessary.

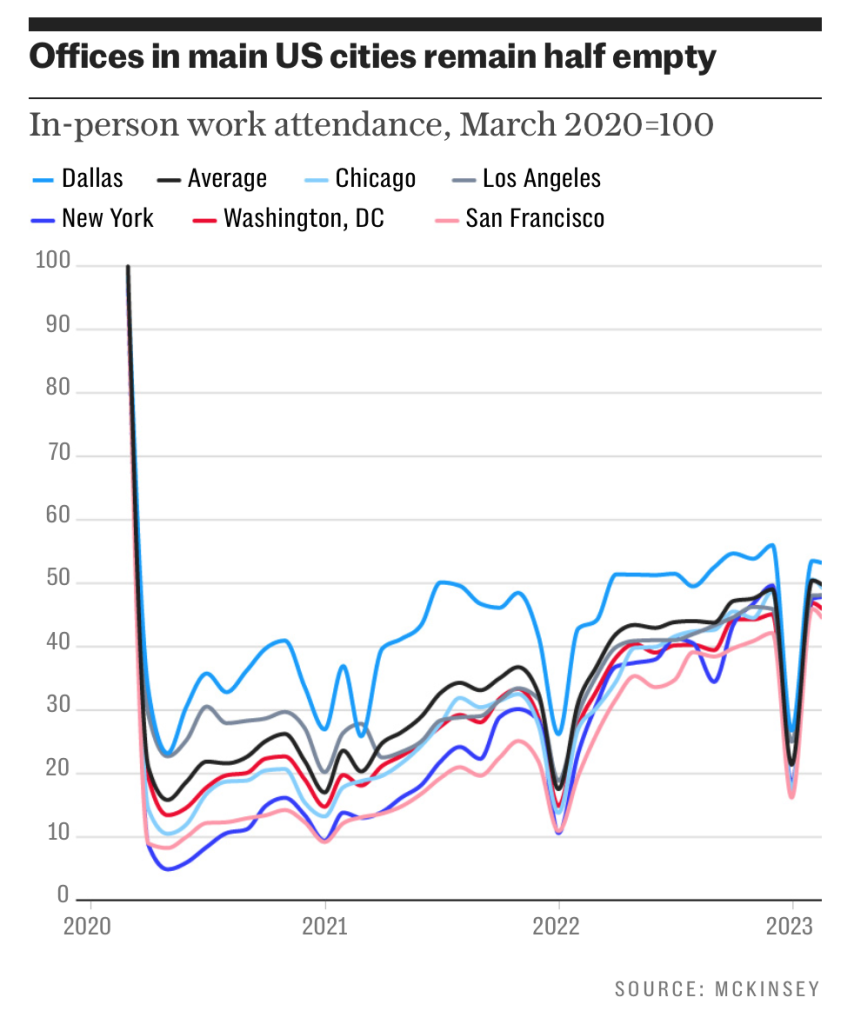

It works great - until it doesn't. As the Federal Reserve embarked on QE and lowered interest rates towards zero several years ago, banks loaded up their balance sheets with low interest bearing debt. When the Fed reversed course with QT and raising rates to combat inflation, many banks were caught with balance sheets full of upside down investments. Unable to keep pace with the yields offered by Money Market Funds (MMFs), they are facing deposit redemptions as money is pulled from the banks to chase yields in MMFs. The situation is leading to fears of a systemic crisis as half of America's banks are reportedly already insolvent.

Consider the saga of Custodia Bank:

Custodia Bank applied for both membership in the Federal Reserve System and for a Fed Master Account. Custodia Bank planned to use a full reserve banking model to satisfy risk requirements of Wyoming where it got it's charter, except it planned to serve the crypto industry. So, with America's War on Crypto (and Operation Choke Point 2.0) in full swing, the Fed denied Custodia's applications with the justification that:

Great job fellas! You certainly understand risk management controls and liquidity risk management practices and know a solid bank when you see one. The last decade is replete with examples (see graph above).

Now consider the saga of the Narrow Bank:

The issue that led to the current wave of regional bank failures was deposit draw downs and then, in SVB's case, a run on deposits from customers holding large, uninsured deposits - the very customers that the Narrow Bank sought (seeks) to service.

Great job fellas! Another triumph of risk management for masses.

It works great - until it doesn't. As the Federal Reserve embarked on QE and lowered interest rates towards zero several years ago, banks loaded up their balance sheets with low interest bearing debt. When the Fed reversed course with QT and raising rates to combat inflation, many banks were caught with balance sheets full of upside down investments. Unable to keep pace with the yields offered by Money Market Funds (MMFs), they are facing deposit redemptions as money is pulled from the banks to chase yields in MMFs. The situation is leading to fears of a systemic crisis as half of America's banks are reportedly already insolvent.

The Fed Knows Best? They Certainly Know Irony

Consider the saga of Custodia Bank:

...

So a few years ago, Wyoming, the state, created a blockchain task force to figure out how to modernize their state law to be more friendly to financial technology, bitcoin, and blockchain technology. And one of the measures that the legislature passed was a law creating special purpose depository institutions. They say, "Look, what we're going to allow with…" they call it the SPDI Charter, and perhaps it's inaptly named because they're not getting started really speedily. "But what we hope to do with this SPDI charter is let banks get a charter that allows them custody cryptocurrency, provide US dollar payments to be an on-ramp and an off-ramp to cryptocurrency, but would not let them lend. Instead, all of their deposits would have to be stored in safe, relatively liquid assets." And so Custodia applies for this SPDI charter, they get it. They want to custody cryptocurrency for institutional investors, family offices.

...

Custodia Bank applied for both membership in the Federal Reserve System and for a Fed Master Account. Custodia Bank planned to use a full reserve banking model to satisfy risk requirements of Wyoming where it got it's charter, except it planned to serve the crypto industry. So, with America's War on Crypto (and Operation Choke Point 2.0) in full swing, the Fed denied Custodia's applications with the justification that:

... Custodia had insufficient risk management and controls, “particularly with respect to overall risk management; compliance with the Bank Secrecy Act and U.S. sanctions … financial projections, and liquidity risk management practices.”

The board also argued that Custodia’s revenue model, which “relies almost solely upon the existence of an active and vibrant market for crypto assets” makes it vulnerable to market volatility, even though the board admitted that “Custodia appears to have sufficient capital and resources to sustain initial operations.”

Great job fellas! You certainly understand risk management controls and liquidity risk management practices and know a solid bank when you see one. The last decade is replete with examples (see graph above).

Narrow Thinking

Now consider the saga of the Narrow Bank:

... the Narrow Bank is a Connecticut chartered bank, and they want to accept deposits, big deposits from institutional investors and just hold them in a Federal Reserve account. These big institutional investors have deposits that are so large that they can't be covered by deposit insurance, which caps out at $250,000. And so when these businesses take money and put it at a bank, they're subject to some risk, the credit risk, the liquidity risk of the underlying bank. And TNB, The Narrow Bank says that they can make a safer place for these institutional investors because instead of lending out the money, subjecting the depositor to credit and liquidity risk, they're just going to take the money and put it in an account at the Fed. And TNB thinks that it could make money because the Federal Reserve pays interest on excess reserves. And so they could earn the money from the Federal Reserve, pass a little bit of it on to their own depositors and pocket the difference, making for profitable business model.

So they got a charter from Connecticut, life seemed to be good, and they asked the Federal Reserve Bank of New York for a master account and then nothing happened. They hear that the board’s become concerned about their business model, that it might impact the Fed's ability to conduct monetary policy. One of the things that they're very worried about is that during times of economic uncertainty, everyone would decide TNB is safer, and so they'd withdraw their money from traditional banks and put it in TNB. And they say that that would be problematic. Another thing that they're worried about is that because TNB wouldn't be constrained by the same sorts of capital rules, that it would just grow bigger and bigger and bigger. And that might make it hard for the Fed to have the same impact in their efforts to control the money supply.

So TNB gets sick of waiting after 18 months or so, and they sue. And the Fed's argument in the suit is, look, we haven't made a decision yet. And the court considers it and says, well, it's right. The Federal Reserve hasn't made a decision, so it's not right for us to consider it. Part of the court's decision there too was, I think, this possibility that the Fed might be able to deny the account on some technical ground. The court thought maybe that the Connecticut charter had expired. It hadn't, Connecticut had given them another 18 months to get the bank off the ground, and Connecticut has extended it a number of times since then. But the Narrow Bank has been waiting now for more than five years for the Fed to decide whether or not they can open an account.

...

The issue that led to the current wave of regional bank failures was deposit draw downs and then, in SVB's case, a run on deposits from customers holding large, uninsured deposits - the very customers that the Narrow Bank sought (seeks) to service.

Great job fellas! Another triumph of risk management for masses.

Last edited:

Mr. Kaloudis

Mr. Kaloudis