Cyprus: Russia's Next Lunch?

by Peter Martino

January 14, 2013 at 3:00 am

Cyprus's banks are on the brink of collapse. As a result of a crisis that began in Greece, and as one of the 17 European countries that use the euro as their currency, Cyprus, a victim of the euro's domino effect, is being dragged down by the eurocrisis, along with the entire southern rim of the eurozone. Since last spring, Cyprus, a small country with barely one million inhabitants, has been negotiating with the other members of the eurozone about a financial bailout. When Greece was given an 85% haircut on its debts, the Cypriot banks suffered heavy losses on top of the huge losses already incurred as a result of a domestic real estate bubble. To stay afloat, Cyprus's banks currently need some €17 bn ($23 bn) -- an immense sum for a country with a 2011 GDP of only €19 bn ($25 bn) and a contracting economy.

Cyprus's fortune, however, is its location. It is the easternmost island in the Mediterranean and of considerable strategic importance. Cyprus is like a huge aircraft carrier situated in front of Turkey, Syria, Lebanon, Israel and Egypt. In addition, huge offshore fields of gas and perhaps oil have recently been discovered in Cypriot territorial waters.

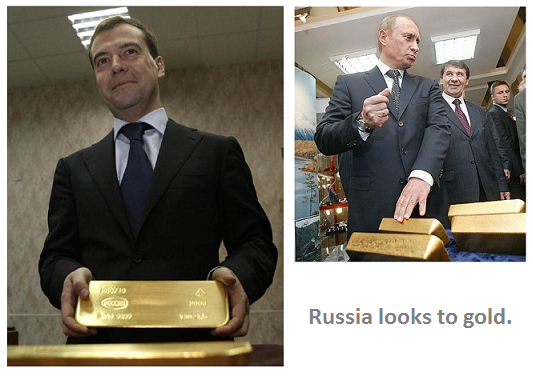

Cyprus is also the place where the Arab Spring meets the Eurocrisis. The Syrian port of Tartus hosts Russia's only naval base in the Mediterranean. The impending fall of the Assad regime in Syria is forcing Russian President Vladimir Putin to look for an alternative to Tartus -- leaving him with only one option: Cyprus.

Politically and economically, Russia and Cyprus are already tied closely together. Cyprus's President. Demetris Christofias, is the leader of the Cypriot Communist Party. He met his wife during his studies at the Russian Academy of Sciences in Moscow in the 1960s. When Russia became "capitalist," the ties between the two countries became even closer. Thousands of wealthy Russians have put their "black money" in Cypriot banks. Although Cyprus joined the eurozone in 2008, its banks have almost no clients from other EU countries. With the exception of Greece, with which the Greek-speaking Cypriots share close cultural and historic ties, Cypriot banks cater almost exclusively to Russian oligarchs; as a consequence, tiny Cyprus is Russia's largest foreign investor.

In November 2011, Cyprus was bailed out by a €2.5 bn loan from Russia. The eurocrisis has since deepened and more money is now urgently needed. Last June, Cyprus turned to the European Union (EU), the eurozone's European Central Bank (ECB) and the IMF, asking for emergency aid of at least €10 bn. In return, however, the EU, ECB and IMF – the so-called Troika – have asked Cyprus to reform its economy. Negotiations over these "structural reforms," such as privatization of state-owned enterprises and reduction of wages, have been dragging on for almost eight months.

No agreement could be reached between the ruling Cypriot Communists, who refused to implement the reforms demanded by the Troika, and Germany, the euro's major paymaster. Next fall, general elections will be held in Germany. With an electorate that is tired of bailing out banks and governments in Greece, Ireland, Portugal and Spain in order to save the euro – a currency which many Germans feel was forced upon them – Chancellor Angela Merkel is reluctant to come to Cyprus's aid.

Last November, a leaked intelligence report of the Bundesnachrichtendienst (BND), the German equivalent of the CIA, made matters even more difficult for Merkel. The report asserted that a bailout of Cyprus would boil down to using German taxpayers' money to save the funds of rich Russians, who deposited up to €26 bn in "black money" in Cypriot banks, which are now on the brink of bankruptcy. The BND accuses Cyprus of creating a fertile ground for Russian money laundering, a charge further exacerbated by the ease with which Russian oligarchs can obtain Cypriot nationality and thus gain automatic access to all the EU member states. The BND said 80 oligarchs have managed to gain access this way to the entire EU.

As the financial blog Testosterone Pit writes: "Taxpayers in other countries, including those in the US – via the US contribution to the IMF – will be asked to [bail out] tiny Cyprus." However, given that Chancellor Merkel has already decided that the euro must be saved at all costs, she has no other option but to bail out Cyprus, including the investments of Russian oligarchs.

In all likelihood, the Cypriot bailout is to be agreed on in principle at a meeting in Brussels next week, and formally approved on February 10. Meanwhile, Cypriot Finance Minister Vassos Shiarly has indicated that Russia might be asked to join the efforts to save Cyprus if the EU approves the bailout. "First there must be an EU agreement, then we might ask them [Russia] to join," Shiarly said.

Some think that it is in Putin's interest to do so, to avoid investigations into the role of Cypriot banks in Russian money laundering. However, Russia's strategic geopolitical interests are a much more important reason for Russia to gain a foothold in Cyprus.

The same applies to Israel. The Jewish state and Cyprus are also currently strengthening their ties. Israel is seeking to work with Cyprus on national gas exploration and extraction. The Cypriot-Israeli rapprochement has already angered Turkey, which is bullying both Nicosia and Jerusalem.

Israel is also collaborating with Cyprus in the EurAsia Interconnector project. This is a undersea cable which will link Israel with Cyprus. The 286-kilometer link will be the world's longest undersea power cable in the world.

If Europe fails to bail Cyprus out, there are at least two countries, Russia and Israel, for whom it makes political, economic and strategic sense to step in. Indeed, while a monetary union between different nations makes little sense, a monetary union between the Cypriot currency and the Israeli shekel would make more sense than the current conflictious monetary marriage between the Cypriots and the Europeans.