- Messages

- 36,149

- Reaction score

- 6,240

- Points

- 288

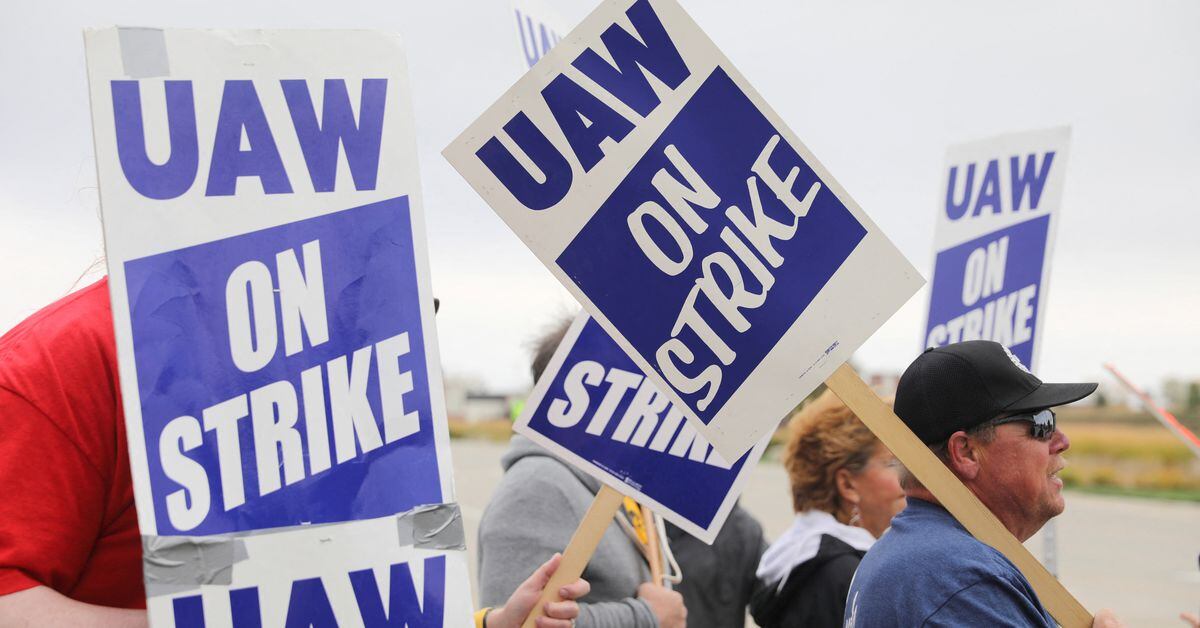

Republicans are bringing new legislation before the US senate which, if passed, would fine dockworker unions up to $2bn a day, making strike action practically impossible.

Introduced by Idaho senator Jim Risch and co-sponsored by fellow Idaho senator Mike Crapo and North Carolina senator Ted Budd, the bill would amend the National Labor Relations Act and Labor Management Relations Act to redefine port slowdowns by maritime workers – including no-shows and work-to-rule strikes – as unfair labour practices.

theloadstar.com

theloadstar.com

Introduced by Idaho senator Jim Risch and co-sponsored by fellow Idaho senator Mike Crapo and North Carolina senator Ted Budd, the bill would amend the National Labor Relations Act and Labor Management Relations Act to redefine port slowdowns by maritime workers – including no-shows and work-to-rule strikes – as unfair labour practices.

Striking dock unions should pay $2 billion a day, say Republican senators - The Loadstar

Republicans are bringing legislation before the US senate which would fine dockworker unions up to $2bn per day.