Crop markets fixed on Black Sea region again: Weekly Commodity Market Update for 7/26/23

Jul 26, 2023

14:25

Market recap (Changes on week as of Monday's close):

- September corn up $.49 at $5.48

- December 2023 corn up $.50 at $5.56

- August soybeans up $.20 at $15.04

- November soybeans up $.28 at $14.06

- August soybean oil up 6.14 cents at 70.90 cents/lb

- August soybean meal up $13.10 at $447.50/short ton

- September 2023 wheat up $.92 at $7.45

- July 2024 wheat up $.65 at $7.64

- June WTI Crude Oil up $4.34 at $78.37/barrel

Weekly Highlights

• US energy stocks were mostly steady week over week on slightly higher gasoline demand. The one exception was ethanol stocks up 21 million gallons or 2%. Ethanol production increased 12 million gallons on the week to the largest volume of the second largest volume of the marketing year.

• Last week’s agricultural export sales volumes for the current marketing year were mixed. Corn and soybeans were on the lower end of expectations, soybean oil and wheat were below all pre-report estimates, but grain sorghum experienced the second largest weekly volume since last September due to China.

• Open interest positions increased across the board: Chicago Wheats (+4.6%), corn (+2.4%), soybeans (+6.5%), soybean oil (+0.3%), soybean meal (+3.2%), cotton (+1.5%), and rough rice (+1.7%).

• Futures and option position trading was pretty active on the week. Producers and merchants increased their short corn position 13,316 contracts while managed money traders shrank their short position. The same was true for soybeans with an additional 7,673 short positions for producer and merchants while managed money traders bought 13,066 positions to add to their net long.

• USDA reported Cattle on Feed as of July 1 to be 98.2% of last year and above the trade’s estimate of 97.7%. The higher number than expected was due to higher than anticipated June placements, which were 102.7%. Marketings were as expected. All cattle and calves in the US of 95.9 million heads was 3% lower than a year ago.

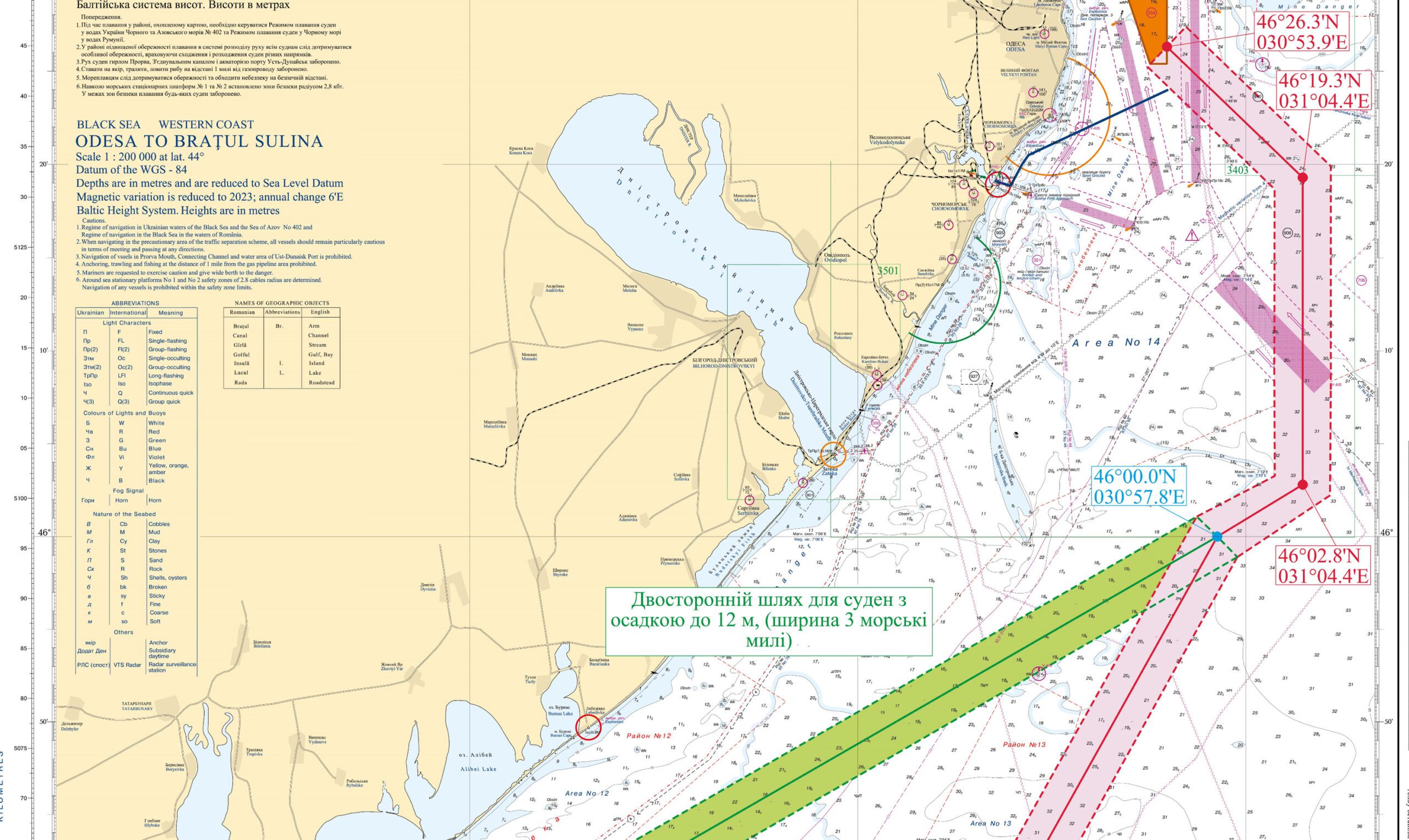

• Russia attacked Ukraine grain export terminals along the Danube River Monday morning- signaling that the war has shifted to an environment where Russia is actively trying to prevent Ukrainian agricultural exports.

• Weekly agricultural export inspections were mixed- corn was down week over week while soybeans, sorghum and wheats were all up. Wheat volumes exceeded all pre-report expectations.

• US corn conditions were flat on the week when the trade was expecting a little increase. Cotton conditions improved slightly and while not good remain well above conditions experience last year. Soybean, and spring wheats conditions all deteriorated a little on the week.

• 68% of the US winter wheat crop has been harvested compared to 75% at this time last year and a three-year average of 77%.

www.oedigital.com

www.oedigital.com