BlackRock today unveils its first tokenized fund issued on a public blockchain, the BlackRock USD Institutional Digital Liquidity Fund (“BUIDL” or the “Fund”). BUIDL will provide qualified investors with the opportunity to earn U.S. dollar yields by subscribing to the Fund through Securitize Markets, LLC.

“This is the latest progression of our digital assets strategy,” said Robert Mitchnick, BlackRock’s Head of Digital Assets. “We are focused on developing solutions in the digital assets space that help solve real problems for our clients, and we are excited to work with Securitize.”

Tokenization remains a key focus of BlackRock’s digital asset strategy. Through the tokenization of the Fund, BUIDL will offer investors important benefits by enabling the issuance and trading of ownership on a blockchain, expanding investor access to on-chain offerings, providing instantaneous and transparent settlement, and allowing for transfers across platforms. BNY Mellon will enable interoperability for the Fund between digital and traditional markets.

“Tokenization of securities could fundamentally transform capital markets. Today’s news demonstrates that traditional financial products are being made more accessible through digitization. Securitize is proud to be BlackRock’s transfer agent, tokenization platform and placement agent of choice in digitizing and expanding access to its investment products,” said Securitize co-founder and CEO Carlos Domingo.

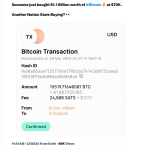

BUIDL seeks to offer a stable value of $1 per token and pays daily accrued dividends directly to investors' wallets as new tokens each month. The Fund invests 100% of its total assets in cash, U.S. Treasury bills, and repurchase agreements, allowing investors to earn yield while holding the token on the blockchain. Investors can transfer their tokens 24/7/365 to other pre-approved investors. Fund participants will also have flexible custody options allowing them to choose how to hold their tokens.

The initial ecosystem participants in BUIDL include Anchorage Digital Bank NA, BitGo, Coinbase, and Fireblocks, among other market participants and infrastructure providers in the crypto industry.

BlackRock Financial Management, Inc., will be the investment manager of the Fund and Bank of New York Mellon will serve as the custodian of the Fund’s assets and its administrator. Securitize will act as a transfer agent and tokenization platform, managing the tokenized shares and reporting on Fund subscriptions, redemptions, and distributions. Securitize Markets will act as placement agent, making the Fund available to eligible investors. PricewaterhouseCoopers LLP has been appointed as the Fund's auditor for the period ending December 31, 2024.

The Fund will issue shares pursuant to Rule 506(c) under the Securities Act of 1933 and Section3(c)(7) of the Investment Company Act. The Fund’s initial investment minimum is $5 million.

BlackRock has also made a strategic investment in Securitize. As part of the investment, Joseph Chalom, BlackRock’s Global Head of Strategic Ecosystem Partnerships, has been appointed to Securitize’s Board of Directors.