You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

QE3 looming

- Thread starter pmbug

- Start date

-

- Tags

- fed money supply qe#

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

swissaustrian

Yellow Jacket

- Messages

- 2,049

- Reaction score

- 0

- Points

- 156

Damn. I can't see anything on that chart. It's all just black on my screen.

Found one I can upload here:

swissaustrian

Yellow Jacket

- Messages

- 2,049

- Reaction score

- 0

- Points

- 156

Looks like they need to spark some irrational exuberance in the economy.

Either this or they have the unintended consequence of a so called crack up boom ( http://seekingalpha.com/article/251276-ludwig-von-mises-and-the-crack-up-boom ) - a stock market rally even if the sthf because of rising inflationary expectations due to money printing and accelerating velocity.

KMS

Big Eyed Bug

As far as I understand it, the real inflation/velocity issue is on hold (read: broken) until the banks actually start loaning/distributing/spending the money they are sitting on that the Bernak has given them to bail them out.

DoChenRollingBearing

Yellow Jacket

Or they can do it the old-fashioned way! Print!

$500 Corzines!

$1000 Obamas

$5000 Bernankes!

C'mon now guys, think BIG!

$500 Corzines!

$1000 Obamas

$5000 Bernankes!

C'mon now guys, think BIG!

ancona

Praying Mantis

Thisw i9s actually frightening. With the lowest velocity in around sixty years, and the highest bank reserves ever recorded, this can only end badly. Weimar? No, think building houses out of bundles of cash instead of bricks, because the cash is worth less than the same volume of bricks.

Gold and silver are the last refuge for us all. I believe I will see in my lifetime, the opportunity to buy a house for ten one ounce silver eagles. I further believe that we will see the worst violence on our soil since the civil war when it gets there.

The left is working overtime to blow the Trayvon Martin case in to something it was not, in a concerted effort to take away our constitutional right to keep and bear arms. This is even more frightening, because when the shit does hit the fan, a gun may be all that stands between you and the golden hord of Trayvon Martins, all looking for some payback and a reason to take down the man.

Gold and silver are the last refuge for us all. I believe I will see in my lifetime, the opportunity to buy a house for ten one ounce silver eagles. I further believe that we will see the worst violence on our soil since the civil war when it gets there.

The left is working overtime to blow the Trayvon Martin case in to something it was not, in a concerted effort to take away our constitutional right to keep and bear arms. This is even more frightening, because when the shit does hit the fan, a gun may be all that stands between you and the golden hord of Trayvon Martins, all looking for some payback and a reason to take down the man.

DoChenRollingBearing

Yellow Jacket

Yeah, that's all I keep hearing about since coming back from Peru. Trayvon this, Trayvon that.

And, yes, right here in FloriDUH! Where else?

Hey! If I go out and buy a hoodie, does that make me BAD? Or at least LOOK bad?

And, yes, right here in FloriDUH! Where else?

Hey! If I go out and buy a hoodie, does that make me BAD? Or at least LOOK bad?

swissaustrian

Yellow Jacket

- Messages

- 2,049

- Reaction score

- 0

- Points

- 156

United States of Weimar:

The has FED bought a staggering 61% of all net US government debt issuance in 2011, says a former Treasury official:

The has FED bought a staggering 61% of all net US government debt issuance in 2011, says a former Treasury official:

http://online.wsj.com/article/SB10001424052702304450004577279754275393064.html?mod=googlenews_wsjDemand for U.S. Debt Is Not Limitless

In 2011, the Fed purchased a stunning 61% of Treasury issuance. That can't last.

The conventional wisdom that nearly infinite demand exists for U.S. Treasury debt is flawed and especially dangerous at a time of record U.S. sovereign debt issuance.

The recently released Federal Reserve Flow of Funds report for all of 2011 reveals that Federal Reserve purchases of Treasury debt mask reduced demand for U.S. sovereign obligations. Last year the Fed purchased a stunning 61% of the total net Treasury issuance, up from negligible amounts prior to the 2008 financial crisis. This not only creates the false appearance of limitless demand for U.S. debt but also blunts any sense of urgency to reduce supersized budget deficits.

Still, the outdated notion of never-ending buyers for U.S. debt is perpetuated by many. For instance, in recent testimony before the Senate Budget Committee, former Federal Reserve Board Vice Chairman Alan Blinder said, "If you look at the markets, they're practically falling over themselves to lend money to the federal government." Sadly, that's no longer accurate.

It is true that the U.S. government has never been more dependent on financial markets to pay its bills. The net issuance of Treasury securities is now a whopping 8.6% of gross domestic product (GDP) on average per annum—more than double its pre-crisis historical peak. The net issuance of Treasury securities to cover budget deficits has typically been a mere 0.6% to 3.9% of GDP on average for each decade dating back to the 1950s.

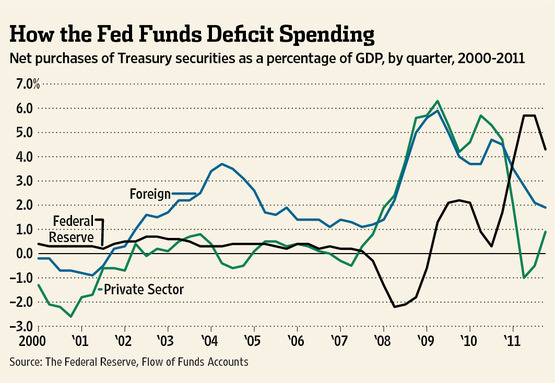

But in recent years foreigners and the U.S. private sector have grown less willing to fund the U.S. government. As the nearby chart shows, foreign purchases of U.S. Treasury debt plunged to 1.9% of GDP in 2011 from nearly 6% of GDP in 2009. Similarly, the U.S. private sector—namely banks, mutual funds, corporations and individuals—have reduced their purchases of U.S. government debt to a scant 0.9% of GDP in 2011 from a peak of more than 6% in 2009.

The Fed is in effect subsidizing U.S. government spending and borrowing via expansion of its balance sheet and massive purchases of Treasury bonds. This keeps Treasury interest rates abnormally low, camouflaging the true size of the budget deficit. Similarly, the Fed is providing preferential credit to the U.S. government and covering a rapidly widening gap between Treasury's need to borrow and a more limited willingness among market participants to supply Treasury with credit.

The failure by officials to normalize conditions in the U.S. Treasury market and curtail ballooning deficits puts the U.S. economy and markets at risk for a sharp correction. Lessons from the recent European sovereign-debt crisis and past emerging-market financial crises illustrate how it is often the asynchronous adjustment between budget borrowing requirements and the market's appetite to fund deficits that triggers a shock or crisis. In other words, budget deficits often take years to build or reduce, while financial markets react rapidly and often unexpectedly to deficit spending and debt.

Decisive steps must be implemented to restore the economy and markets to a sustainable path. First, the Fed must stabilize and purposefully reduce the size of its balance sheet, weaning Treasury from subsidized spending and borrowing. Second, the government should be prepared to lure natural buyers of Treasury debt back into the market with realistic interest rates.

If this happens, the resulting higher deficit may at last force the government to make deficit and entitlement reduction a priority. First and foremost, however, we must abandon the conventional wisdom that market demand for U.S. Treasury debt is limitless.

Mr. Goodman is president of the Center for Financial Stability and previously served at the U.S. Treasury.

DCFusor

Yellow Jacket

Like Kyle said, "the ten yr is at two, what crisis?". What a setup. Can I stay solvent long enough for the market to become rational?

Peter Schiff said:... Somebody is going to have to buy all of those bonds and if the Fed is not going to do it, who will? Right now, the Fed is doing QE. Whether they want to officially call it QE, they are doing it. They are doing Operation Twist and buying government bonds.

The Fed has to buy government bonds to keep interest rates from skyrocketing. As they stop, rates are going to go up and when they it will choke off the ‘recovery’ that is dependent on low rates.

So, if you take the Fed at its word, this is going to be a bigger disaster (than Europe). I think there is going to be more suffering. If you think that the riots are bad in Greece, wait until you see what the riots are going to be like here.

http://kingworldnews.com/kingworldn...tion_to_Fed_Minutes_Wrong,_QE3_is_Coming.html

bushi

Ground Beetle

- Messages

- 968

- Reaction score

- 13

- Points

- 143

...that makes sense. I was wondering, what IDIOTS are buying US govt. bonds, supposedly in such a high demand, when even such a financial market's noob as meself can clearly see, US GOVT IS BROKEN, and besides, these bonds do not even match the inflation??? Why, is it not simpler just to stuck all that cash into the mattress, and take out 3-4% of it annually, and burn it in your backyard??

Now I know, what idiots are behind that. Makes a PERFECT sense!

What a nice centrally-planned economy, Lenin would be proud of his American commerades of today! That's just preposterous!

Now I know, what idiots are behind that. Makes a PERFECT sense!

What a nice centrally-planned economy, Lenin would be proud of his American commerades of today! That's just preposterous!

Last edited:

Vampire Squid telegraphing the support for QE3?

http://www.zerohedge.com/news/its-l...oldman-stumbles-answer-and-changes-rules-game

... Here is what is of absolutely critical importance in the just released Goldman letter, nested deep in Hatzius' final paragraph, where it would otherwise be missed by most:...we have found some evidence that at the very long end of the yield curve, where Operation Twist is concentrated, it may be not just the stock of securities held by the Fed but also the ongoing flow of purchases that matters for yields...

For those who are aware of the Fed's sentiment vis-a-vis the debate of stock vs flow of money effect, this will be a stunning revelation. Especially since it vindicates what we have been saying since day one, namely that when it comes to securities price formation in a centrally-planned regime, it is flow not stock that matters. And as those who follow the Fed's thinking know too well, the Fed is convinced it is stock, not flow that serves as a consistent catalyst for subjective risk valuation. The above quote is just the first crack in the Fed's thinking, because if Goldman now believes this, so will Bill Dudley, following his next meeting with Jan Hatzius at the Pound and Pence, and shortly thereafter, it will become canon at the Fed.

One way of visualizing what this means is to think of a shark which has to be constantly in motion in order to survive. Well, the allegory of Jaws can be applied to liquidity addicted capital markets. Translated simply, it means that it is irrelevant if the Fed's balance sheet is $1 million, $1 trillion or $1,000 quadrillion. A primacy of flow over stock means that UNLESS THE FED IS ACTIVELY ENGAGING IN MONETIZATION AT EVERY GIVEN MOMENT, THE IMPACT FROM EASING DIMINISHES PROGRESSIVELY, ULTIMATELY APPROACHING ZERO AND SUBSEQUENTLY BECOMING NEGATIVE!

We don't have sufficient time to go into the nuances of what this revolutionary run-on sentence means on this good Friday, suffice to say that it makes virtually all the literature on modern monetary theory (in practice of course, the theoretical part is such gibberish that only fans of MMT and Neo-Keynesianism care about it - something nobody actually in the market gives a rat's ass about) obsolete. It also means that absent "flow" or instantaneous Fed monetization engagement at any given moment, risk will collapse, regardless of the actual size of the Fed's balance sheet (which of course has other structural limitations). What is most critical is that this one statement from Hatzius sows the seeds of doubt, and provides a decoupling between prevalent risk prices, and explicit levels of historical Fed monetization. Because what the ascendancy of the flow model means is that unless the Fed is willing to telegraph that it will monetize devaluing assets in perpetuity, thus providing the "flow", the Fed is assured at failing at its only real mandate: keeping the Russell 2000 pumped up.

And while the Fed may be happy to sacrifice its balance sheet at the altar of Dow 36,000 just to preserve the Wealth Effect fallacy, the other counterliability, the US Treasury stock, which by implication will have to rise as it will be the security monetized the most to keep the deficit funded, may not be quite as pliable, and eager to rise parabolically, especially in a time when more and more question the reserve status of the USD, when faced with the ascendancy of the CNY.

Finally, the market still having a trace of discounting left in it, will become quite aware of all these considerations and deliberations, and will promptly demand a practical application of the "flow" model. Which also means that absent constant, ongoing monetization, either sterilized or not (although as we pointed out earlier this week, the opportunity for ongoing sterilization by the Fed is now almost finished as it will have just 3 months of short-end bonds left to sell past June), stocks will crash.

Unwittingly, Goldman may have just resorted to the nuclear option to force the Fed to engage in monetization much faster than it would have otherwise done so, by diametrically changing how Goldman, the Fed, and thus the market perceives Fed intervention.

Or maybe it was all too "wittingly"...

http://www.zerohedge.com/news/its-l...oldman-stumbles-answer-and-changes-rules-game

ancona

Praying Mantis

QE3 helps no one but stock and bond holders. It will effectively stop any "recovery" dead in it's tracks. The inflation that will be unleashed will cause any up-tick in productivity or whatever to be eaten alive.

PM's bhowever, will go absolutely bananas. I say bring it the fuck on.

PM's bhowever, will go absolutely bananas. I say bring it the fuck on.

QE3 helps no one but stock and bond holders. It will effectively stop any "recovery" dead in it's tracks. The inflation that will be unleashed will cause any up-tick in productivity or whatever to be eaten alive.

PM's bhowever, will go absolutely bananas. I say bring it the fuck on.

Well.. We need higher rates in order for non US government entities to be willing to by our bonds.

Higher rates would kill the government's budget plans. With interest already around 7% of expenses (almost 10% of revenue) a spike up in that number would be devastating. They have to kick the can down the road, debase and hope for a miracle to maintain the current standard of living.

Last night it was uber-dove Janet Yellen, today it is uberer-dove, former Goldmanite (what is it about Goldman central bankers and easing: Dudley unleashing QE2 in 2010, Draghi unleashing QE LTRO in Europe?) Bill Dudley joining the fray and saying QE is pretty much on the table. Of course, the only one that matters is Benny, and he will complete the doves on parade tomorrow, when he shows that all the hawkish rhetoric recently has been for naught. Cutting straight to the chase from just released Dudley comments:"we cannot lose sight of the fact that the economy still faces significant headwinds and that there are some meaningful downside risks... To sum up, the incoming data on the U.S. economy has been a bit more upbeat of late, suggesting that the recovery may be getting better established. But, while these developments are certainly encouraging, it is far too soon to conclude that we are out of the woods in terms of generating a strong, sustainable recovery. On the inflation front, the year-over-year rate of consumer price inflation has slowed in recent months, and despite the recent rise of gasoline prices, we expect inflation to moderate further in 2012." Translate: NEW QE is but a CTRL-P keystroke away now that all the inflation the Fed usually ignores continues to be ignored.

...

http://www.zerohedge.com/news/dudley-joins-yellen-leaving-qe-door-wide-open

With Fed peeps, the messaging is important irrespective of any facts. They are currently signalling support for more intervention. Yellen indicated ZIRP to last though 2015 BTW.

ok, dumb question

why are the banks sitting on all that free money ?

Yes i know they are technically broke and they have to be able to pretend they are solvent by holding a % of their nominal loan book and they are scared to lend to each other

but if the CB's are prepared to bail em out in perpetuity with ever more printing, why tf cant they push money out for dumbass consumer loans at 3%, or even 1%, if thats what it would take to get borrowing and spending moving .......

ok so everyones mortgage can be renegotiated as well and the banks could be worried that their revenue of unearned interest will be reduced but if their supply of free money is assured, then it would seem to be quite simple to make it attractive to lend/borrow

great for a bit of inflation too ........

so what am i missing ?

why are the banks sitting on all that free money ?

Yes i know they are technically broke and they have to be able to pretend they are solvent by holding a % of their nominal loan book and they are scared to lend to each other

but if the CB's are prepared to bail em out in perpetuity with ever more printing, why tf cant they push money out for dumbass consumer loans at 3%, or even 1%, if thats what it would take to get borrowing and spending moving .......

ok so everyones mortgage can be renegotiated as well and the banks could be worried that their revenue of unearned interest will be reduced but if their supply of free money is assured, then it would seem to be quite simple to make it attractive to lend/borrow

great for a bit of inflation too ........

so what am i missing ?

ancona

Praying Mantis

Rblong,

They are sitting on it because they have to. They have to have a certain margin of cash to cover the minimum requirements on their leverage.

They are sitting on it because they have to. They have to have a certain margin of cash to cover the minimum requirements on their leverage.

thought i had covered that, Ancona

"they have to be able to pretend they are solvent by holding a % of their nominal loan book"

It just seems so simple to give em even more on the condition they DONT hang on to it, yet whatever they can earn from it they keep.

And the % they are supposed to hold is utterly irrelevant if they are deemed too important to fail .........

"they have to be able to pretend they are solvent by holding a % of their nominal loan book"

It just seems so simple to give em even more on the condition they DONT hang on to it, yet whatever they can earn from it they keep.

And the % they are supposed to hold is utterly irrelevant if they are deemed too important to fail .........

swissaustrian

Yellow Jacket

- Messages

- 2,049

- Reaction score

- 0

- Points

- 156

Jim Rickards expects a first QE hint by the FED this month:

swissaustrian

Yellow Jacket

- Messages

- 2,049

- Reaction score

- 0

- Points

- 156

OK, the QE3 trade has clearly started as of today (abysmal unemployment numbers). Now the speculators will return to pm markets, making them much more volatile over the next three weeks (FOMC meets June 19-20). If the FED doesn't deliver, we might see a huge selloff in pms (like on 2-29). But I'm sure they'll be higher than today by then. The joker is the USD. If it appreciates much more, pms might not go up that much in USD terms. But besides that we should have bottomed out at 1530 / 26.2 for the next three weeks.

ancona

Praying Mantis

Futures are off almost 200, but I have seen that in hte morning and a vapor rally at 3:30 bringing the market all the way back to even. We'll see, but today looks like rough water sailing with pretty strong headwinds.

swissaustrian

Yellow Jacket

- Messages

- 2,049

- Reaction score

- 0

- Points

- 156

The turnarround in stocks has already begun. European stocks are off more than 1% of their 8:30 am lows. EUR/USD is up 0.4% from it's lows.

It's gonna be a green day for stocks today (j/k, probably not)

(j/k, probably not)

It's gonna be a green day for stocks today

Just got an email from Graham Summers:

June 1, 2012

Sorry Folks, QE 3 Ain't Coming... Even the Fed Doves Admit It

Once again the US economy is tanking and everyone is talking QE 3. Sorry folks, it ain't coming. Bernanke said point blank that it was less attractive as a monetary tool as far back as May '11!!!Q. Since both housing and unemployment have not recovered sufficiently, why are you not instantly embarking on QE3? -- Michael A. Kamperman, Waco, Tex.

Mr. Bernanke: "Going forward, we'll have to continue to make judgments about whether additional steps are warranted, but as we do so, we have to keep in mind that we do have a dual mandate, that we do have to worry about both the rate of growth but also the inflation rate...

"The trade-offs are getting -- are getting less attractive at this point. Inflation has gotten higher. Inflation expectations are a bit higher. It's not clear that we can get substantial improvements in payrolls without some additional inflation risk. And in my view, if we're going to have success in creating a long-run, sustainable recovery with lots of job growth, we've got to keep inflation under control. So we've got to look at both of those -- both parts of the mandate as we -- as we choose policy"

http://economix.blogs.nytimes.com/2011/04/28/how-bernanke-answered-your-questions/

Even the biggest monetary doves are now agreeing with Bernanke. Bill Dudley, of the New York Fed, who's been braying for more QE for over a year had the following to say on Wednesday:Fed's Dudley: If Growth Continues, More Fed Stimulus Unwarranted

The leader of the Federal Reserve Bank of New York repeated Wednesday his expectation that the U.S. central bank will not need to provide additional stimulus to the economy, even as he left the door open to further action.

Acknowledging the options before the central bank each have costs and benefits, New York Fed president William Dudley said "as long as the U.S. economy continues to grow sufficiently fast to cut into the nation's unused economic resources at a meaningful pace, I think the benefits from further action are unlikely to exceed the costs."

http://online.wsj.com/article/BT-CO-20120530-712819.html

Folks if you're buying into the whole QE 3 is coming on June 6th argument you're out of your minds. This is an election year. If the Fed announces QE 3 now, Obama is done. Do you really think this is going to happen when even the Fed's biggest doves are noting that the consequences of QE outweigh the benefits?

With that in mind, Europe will be collapsing as no one (not the ECB, not the IMF, not the ESM, and not even the Fed) will be stepping in to prop it up. The reason? NONE of these entities have the funds (Europe's banking system is $46 trillion in size) to do so (bank runs are pushing leverage levels even higher in Spain, Greece and elsewhere).

Moreover, the political environments for their organizations (the US for the Fed and IMF and Germany for the ECB and ESM) will not permit a massive intervention. If the Fed cranks up the printing press, Obama loses any hope of re-election. If the ECB cranks up the printing press, Germany walks. End of story.

...

swissaustrian

Yellow Jacket

- Messages

- 2,049

- Reaction score

- 0

- Points

- 156

This Graham Summers guy is also posting on ZH (as "Phoenix Capital Research") and he has been calling an "imminent" collapse since late 2010 over and over again.

He also gets a lot of facts wrong, e.g. confusing the EU (European Union = supranational organization of nationstates) with the Eurozone (monetary union which does NOT unite all EU member states, e.g. Great Britain, Sweden, Denmark, the Eastern members) repeatedly.

In this email he says that "the whole QE 3 is coming on June 6th argument" is flawed. I agree, because the FOMC meets 2 weeks later, on June 19-20: http://www.federalreserve.gov/whatsnext.htm

This is typical for Mr Summers, he can't do simple research it seems.

I'm with Jim Rickards (see video above: http://www.pmbug.com/forum/f4/qe3-looming-32/index4.html#post7468 ), either the FED announces QE3 in June or they won't act until after the election. The August meeting is too close to the election.

He also gets a lot of facts wrong, e.g. confusing the EU (European Union = supranational organization of nationstates) with the Eurozone (monetary union which does NOT unite all EU member states, e.g. Great Britain, Sweden, Denmark, the Eastern members) repeatedly.

In this email he says that "the whole QE 3 is coming on June 6th argument" is flawed. I agree, because the FOMC meets 2 weeks later, on June 19-20: http://www.federalreserve.gov/whatsnext.htm

This is typical for Mr Summers, he can't do simple research it seems.

I'm with Jim Rickards (see video above: http://www.pmbug.com/forum/f4/qe3-looming-32/index4.html#post7468 ), either the FED announces QE3 in June or they won't act until after the election. The August meeting is too close to the election.

Pretty much everything Mr. Summers posts or emails is an ad for his investment newsletter, so definitely take with a grain of salt. What I thought was interesting was his view that QE3 would be bad news for Obama politically. Maybe the initial annoucement will cause some grumbles in the small segment of the population that cares about a sound dollar, but I believe that the heroin-like high from new money would carry good favor politically in November. Anyway, I thought it was interesting for a contrarian take.

swissaustrian

Yellow Jacket

- Messages

- 2,049

- Reaction score

- 0

- Points

- 156

http://kingworldnews.com/kingworldn...mergency_Fed_Meeting_&_Gold_Backed_Bonds.htmlCoxe also discussed QE3: “The payroll number, what this did was remind people that the figure who said the US isn’t doing very well at all was Ben Bernanke. The market quite correctly assumes that this is going to mean that he’s going to be forced into QE3. He won’t be fighting it.

But he’s got members of the Fed Board who, up until now, have opposed him because they thought the economy was stronger. So we have the combination of the eurozone, which may find a way to try to get some gold in to save its system, and we now have the reasonable prospect of money printing over here. In other words, the case for gold is starting to get quite wondrous.”

ancona

Praying Mantis

After Friday, I believe we will see some contagious fear trading this week. I have a very clear memory of 4, 5, 6 and eve3n 700 point drops on the Dow just a few short years ago, and the problems plauging the system have only grown since then. Nothing substantive has been fixed.

Every single bit of positive legislation aimed at the banks has been successfully watered down and even completely cock blocked by the banking loibby, who poured billions on to K street.

It will take a full on catastrophic crash of the markets for the Fed to respond in any meaningful way.

Every single bit of positive legislation aimed at the banks has been successfully watered down and even completely cock blocked by the banking loibby, who poured billions on to K street.

It will take a full on catastrophic crash of the markets for the Fed to respond in any meaningful way.

Goldman Sachs setting QE expectations and ZH comments on the likely timeline ...

http://www.zerohedge.com/news/crunch-time-goldmans-confidence-qe-will-be-announced-june-20-has-grown

Goldman's Jan Hatzius ...: "Our confidence that the FOMC will ease policy once more at the June 19-20 meeting has also grown... Our baseline remains that Fed officials will purchase a mixture of mortgages and long-term Treasuries, financed via balance sheet expansion and possibly coupled with an extension of the forward guidance into 2015. ..." Well, if anything, global or Fed-based easing will most likely not come before the Greek June 17 elections - after all Greek confidence has to be crushed heading into the Euro referendum, and the only way to do this is by facilitating collapsing markets. So those hoping for a groundbreaking ECB announcement on June 6 will be disappointed. But June 20? That is fair game. ...

http://www.zerohedge.com/news/crunch-time-goldmans-confidence-qe-will-be-announced-june-20-has-grown

bushi

Ground Beetle

- Messages

- 968

- Reaction score

- 13

- Points

- 143

Just got an email from Graham Summers:

Bernanke said:Q. Since both housing and unemployment have not recovered sufficiently, why are you not instantly embarking on QE3? -- Michael A. Kamperman, Waco, Tex.

Mr. Bernanke: "Going forward, we'll have to continue to make judgments (...) but also the inflation rate...

"The trade-offs are getting -- are getting less attractive at this point. Inflation has gotten higher. Inflation expectations are a bit higher. It's not clear that we can get substantial improvements in payrolls without some additional inflation risk. And in my view, if we're going to have success in creating a long-run, sustainable recovery with lots of job growth, we've got to keep inflation under control.

Wait a second, does that above mean, that mr. Bernanke assumes, that whatever free-money they provide to "economy", it ends up as payrolls increases??? Is he mad? Folks down the pecking order (re: payrolls recipients), don't even get a whiff at that money, as it is all being used to perpetuate the robbery of the savers/middleclass by the big financials. Let me make it clear: payrolls NEVER catch up with inflation. IF you need a proof, just look at the average '50 middle-class family (and before), where only father was a single bread-winner (and the family was better off, financially). Since ten, this whole disposable income/standards of living/savings things, are only going down, on average (and studies have been done, showing this clearly).

I always held the academics, who are this completely disconnected from the reality, in my deepest contempt.

More MOPE?

http://www.foxbusiness.com/investin...l-doubts-on-decoupling-between-us-and-europe/

...

Last week Morgan Stanley (MS: 12.84, +0.48, +3.84%) forecasted an 80% chance of the Fed launching a third round of quantitative easing, dubbed QE3, at its meeting ending on June 20.

...

http://www.foxbusiness.com/investin...l-doubts-on-decoupling-between-us-and-europe/

... the Fed's trusty mouthpiece, Jon Hilsenrath, ... two weeks before the all critical June 20 FOMC meeting, the faithful Fed scribe has been charged with his latest leak commission: "Fed Considers More Action Amid New Recovery Doubts." And as it has been leaked (now that people have actually done the appropriate math), so it shall be.

...

More: http://www.zerohedge.com/news/here-come-hilsenrath-leak-fed-considers-more-action

ancona

Praying Mantis

These "leaks" are getting a bit tiring. If the Fed does anything big before the election, the dihmmicrats can kiss their 'collective' asses goodbye. So, in that sense anyway, I say bring it on!