You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

*Sigh* Platinum takes a dump, again...

- Thread starter DoChenRollingBearing

- Start date

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

my majic 8 ball just keeps comming up "ask again later" ......I asked that very question to a homeless Cuban high priestess in Miami who lives under I-95 in Brickell. She rolled some chicken bones around in the sand and blew cigar smoke in my face, then exclaimed "mil quinientos!"

Ahh forget quiet, Let's Ride.

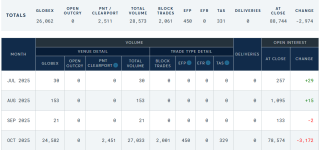

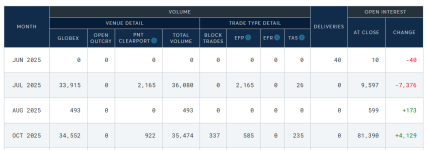

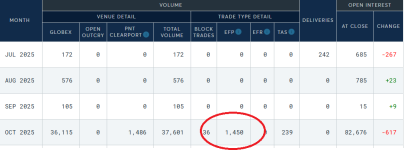

So I just realized they have another page that tracks the movement day to day. However, there is a VERY interesting thing on the Platinum.

Look at that HUGE EFP trade for Platinum... Someone stood for 2,165 Contracts or 108,250 oz yesterday. Comparing that to Silver only had 100 or 50,000 oz.

They even took delivery from some October contracts??? Am i reading that right, paying an extra $11 or so premium.

Look at that HUGE EFP trade for Platinum... Someone stood for 2,165 Contracts or 108,250 oz yesterday. Comparing that to Silver only had 100 or 50,000 oz.

They even took delivery from some October contracts??? Am i reading that right, paying an extra $11 or so premium.

That is why there are significant premiums on the Shanghai Exchange where delivery is assumed. Lots of dealers performing arbitrage for quick $. What happens when western dealers are exposed where they cannot deliver or go bankrupt in a squeeze?So I just realized they have another page that tracks the movement day to day. However, there is a VERY interesting thing on the Platinum.

View attachment 16730

Look at that HUGE EFP trade for Platinum... Someone stood for 2,165 Contracts or 108,250 oz yesterday. Comparing that to Silver only had 100 or 50,000 oz.

They even took delivery from some October contracts??? Am i reading that right, paying an extra $11 or so premium.

- Messages

- 660

- Reaction score

- 556

- Points

- 268

Salesman: "Well, that's the price if you take delivery. If you agree to never take delivery, we can give you a huge discount! Will 50% off make the deal today?"intresting how when you have to deliver prices go up LOL

I like these kinds of dumps.

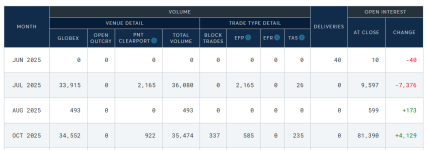

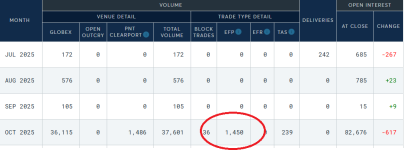

Besides the normal deliveries someone has been taking an EFP of 500-600 contracts almost Everyday lately. That's like $40 million bucks a day.

Oops, that was silver. Try again. Holy cow Pt is MUCH bigger.

Wed June 25 - 2,750 contracts

Thurs - 785 contracts

Fri - 2,591 contracts in OCT

Mon - 850 contracts EFP plus normal 2,088 delivered in July

Tues - 1,450 contracts

Total - 10,514 contracts or 525,000 troy oz or about $735 Million dollars.

Besides the normal deliveries someone has been taking an EFP of 500-600 contracts almost Everyday lately. That's like $40 million bucks a day.

Oops, that was silver. Try again. Holy cow Pt is MUCH bigger.

Wed June 25 - 2,750 contracts

Thurs - 785 contracts

Fri - 2,591 contracts in OCT

Mon - 850 contracts EFP plus normal 2,088 delivered in July

Tues - 1,450 contracts

Total - 10,514 contracts or 525,000 troy oz or about $735 Million dollars.

Last edited:

I need a little help from PMBug or someone who has paid more attention. This is the latest CME Group Pt warehouse supply.

I think the Eligible total is what they can deliver, correct? It can't be only 93,834 oz.... that has to be in thousands or something. That's only 1,877 contracts. Now I'm just getting confused. Although I do know that's why they send so much to EFP in London is because they just don't have that much supply.

| TOTAL REGISTERED | 220,633.806 | 0.000 | 0.000 | 0.000 | 0.000 | 220,633.806 | |

| TOTAL ELIGIBLE | 105,710.879 | 0.000 | 11,876.219 | -11,876.219 | 0.000 | 93,834.660 | |

| COMBINED TOTAL | 326,344.685 | 0.000 | 11,876.219 | -11,876.219 | 0.000 | 314,468.466 |

I think the Eligible total is what they can deliver, correct? It can't be only 93,834 oz.... that has to be in thousands or something. That's only 1,877 contracts. Now I'm just getting confused. Although I do know that's why they send so much to EFP in London is because they just don't have that much supply.

... I think the Eligible total is what they can deliver, correct? ...

No, it's the Registered category that is used to deliver against contracts. I'm not at my computer at the moment and don't follow COMEX platinum, so I'm not sure how many ounces are represented by a platinum contract off the top of my head. A COMEX silver contract is 5k troy ounces. Gold is 100 or 400 IIRC.

Platinum is 50 oz per contract. That I know.

Ok so if they have the Registered category available that's still only enough to cover 4,400 contracts. And they delivered at least 2,000 contracts just on Monday.... And someone has been standing for delivery/EFP for over 1,000 / day. Anyone see a possible problem here? The market might be catching on.

Per request in the silver squeeze thread, the COMEX's COT report(s) can be found here:

For Platinum, as of June 24, swap dealers are short 21,985 contracts. There is a total short position of 85,700+ (I'm on my phone, so not adding up the exact number).

CFTC Commitments of Traders Long Report - Other (Combined)

This is the viewable version of the most recent release of the Other disaggregated long form combined commitments report.

www.cftc.gov

For Platinum, as of June 24, swap dealers are short 21,985 contracts. There is a total short position of 85,700+ (I'm on my phone, so not adding up the exact number).

Its 86,016 so really close. Platinum looks really similar to silver I think. We need these producers to stop using the Comex to hedge, especially miners.

Palladium looks different as its the only one that has the Managed Money (the dumb money the insiders try to steal from) are still Net Short.

Palladium looks different as its the only one that has the Managed Money (the dumb money the insiders try to steal from) are still Net Short.

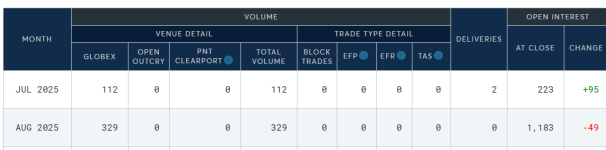

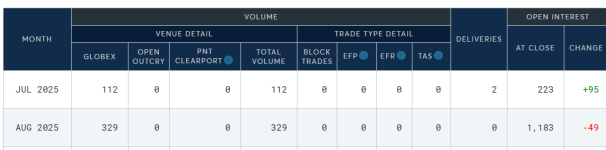

Looks like the Comex is really, really hurting for Platinum. Look at yesterday, only delivered 2 contracts while OI was up 95.

That's 3 of the last 5 days where the OI increased in the immediate delivery contract.

Delivered 206 contracts (10,300 oz) while OI has stayed right around 200, to 114 to 229 to 128 and back to 223.

That's 3 of the last 5 days where the OI increased in the immediate delivery contract.

Delivered 206 contracts (10,300 oz) while OI has stayed right around 200, to 114 to 229 to 128 and back to 223.

I need a little help from PMBug or someone who has paid more attention. This is the latest CME Group Pt warehouse supply.

TOTAL REGISTERED 220,633.806 0.000 0.000 0.000 0.000 220,633.806 TOTAL ELIGIBLE 105,710.879 0.000 11,876.219 -11,876.219 0.000 93,834.660 COMBINED TOTAL 326,344.685 0.000 11,876.219 -11,876.219 0.000 314,468.466

I think the Eligible total is what they can deliver, correct? It can't be only 93,834 oz.... that has to be in thousands or something. That's only 1,877 contracts. Now I'm just getting confused. Although I do know that's why they send so much to EFP in London is because they just don't have that much supply.

So I just stumbled into clicking on this again and its Pretty Surprising. It's only been two weeks and check it out now. Registered Pt fell from 220,633 to just 161,133 oz... ( how the hell do they have a fractional Oz anyway? lol). That is 59,500 drop or 27% in TWO WEEKS.

| TOTAL REGISTERED | 161,133.037 | |

| TOTAL ELIGIBLE | 115,298.366 | |

| COMBINED TOTAL | 276,431.403 |

We've been seeing about 100 contracts wanted per day lately. At that rate the Inventory is gone in....

32 days.

32 days.

COMEX has standards/specifications for good delivery bars, but the bars aren't necessarily exactly at spec. They should be "at least", but could also be "slightly more". At least, that's my understanding.

COMEX has standards/specifications for good delivery bars, but the bars aren't necessarily exactly at spec. They should be "at least", but could also be "slightly more". At least, that's my understanding.

Well ya I suppose that could be as it is with the Silver 1,000 oz bars. But Pt being so small 10 oz bars seem to be the deliverable. Perhaps there is a larger industrial type bar.

Ya, and noted above that the dealers were short 22,000 contracts with only about 3,200 contracts even available in inventory. That's almost 7x more short than exists in their inventory.

Once physical platinum from the COMEX is sent overseas never to return I suppose they will hire an agent to buy up the last 500 coins from online dealers and make it real interesting?

Absolutely I think they will buy up retail sources as a last resort. Might even be doing that now. But the US hasn't made a Pt Eagle in years. Doubt there were ever US made bars. England and Canada, Austria and Austrailia are still making a few.

Its just a tiny amount, I counted 10-10 oz bars now on Apmex. 2 contracts worth, whoppie.

They might find a Pt Eagle laying around. Just chisel a few extra zeros on the coin.

I suppose if you go to SD, BE, Bold, BGASC, Liberty, Silver Gold Bull, Money Metals Exchange, Monument Metals and KITCO you could probably score 500 oz in various sizes, but then the cat is out of the bag. Future spot price might be a bit higher with no physical inventory in NY or CA, but buying physical on the Shanghai Exchange might cost an extra $500-$1k per ounce. That's their game.

When I first started buying platinum coins only Kitco and SD had any regular inventory and little selection. Get what you want while you can folks because it will be unobtanium in < 7 years. Regular stackers will cash in at some point and then you need through Russia, South Africa or China to get more.

You can't just open a new platinum mine. It's byproduct from copper and gold mining and production cannot simply be ramped up like the petroleum industry.

Crazy talk is $20k per oz by the end of the bull run. I am cashing out before then.

When I first started buying platinum coins only Kitco and SD had any regular inventory and little selection. Get what you want while you can folks because it will be unobtanium in < 7 years. Regular stackers will cash in at some point and then you need through Russia, South Africa or China to get more.

You can't just open a new platinum mine. It's byproduct from copper and gold mining and production cannot simply be ramped up like the petroleum industry.

Crazy talk is $20k per oz by the end of the bull run. I am cashing out before then.

Last edited:

Ya, its just a tiny, tiny market.... makes it a little more ripe for squeezy squeezes too.

most states won't allow a car to operate without one... Now if things go badly sure, but there won't be an efficient recycling system either.

Well even Metals Focus (total scam) says the Pt market has been in about a 1 million oz deficit for the past three years.

platinuminvestment.com

platinuminvestment.com

It looks like they are trying to say about 50,000 to 100,000 oz of Pt goes into auto each year.

Charts & Tables - Supply & Demand - World Platinum Investment Council – WPIC®

Supply & Demand - Charts & Tables

It looks like they are trying to say about 50,000 to 100,000 oz of Pt goes into auto each year.

my state missouri....they are required but there is no form of checking or enforcement.... probably the computers on the cars themselves would cause issues if the cats were gone........lets just say at 20k pricing Cat recycling would be more agressive LOLmost states won't allow a car to operate without one... Now if things go badly sure, but there won't be an efficient recycling system either.

Just doing a little more research and it looks like the total US Production in 2023 was 2,900 kg. Or just over 93,000 oz. That's only 1860 contracts for reference.