jelly

Predaceous Stink Bug

- Messages

- 159

- Reaction score

- 265

- Points

- 198

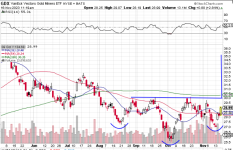

Watch, silver will plummet 10% tomorrow.The only shimmer of hope I see is the fact that silver is holding up nicely, going sideways the past few weeks. As dismal as the miners have been, I would expected silver to be below 20.

Friday is options expiry in stocks. I'd guess we see some continued price fixing for the rest of the week. Next week will free things up.