It busted thru $2200 on the way to $2300 possibly by Friday? Futures were up as much as $30 last night and slowed down to the teens this morning, so I was able to buy a few small gold and platinum coins at Friday's close. Platinum is cheap like silver, but neither are gold.

Gold stackers have been waiting for this since $1500, but instead of euphoria I feel anxiety of what economic conditions are being telegraphed. I might even go long on a couple of stock/BTC ETFs to participate in the sugar high. I was able to buy 9 month CDs on Friday @ 5.35% from JP Morgan.

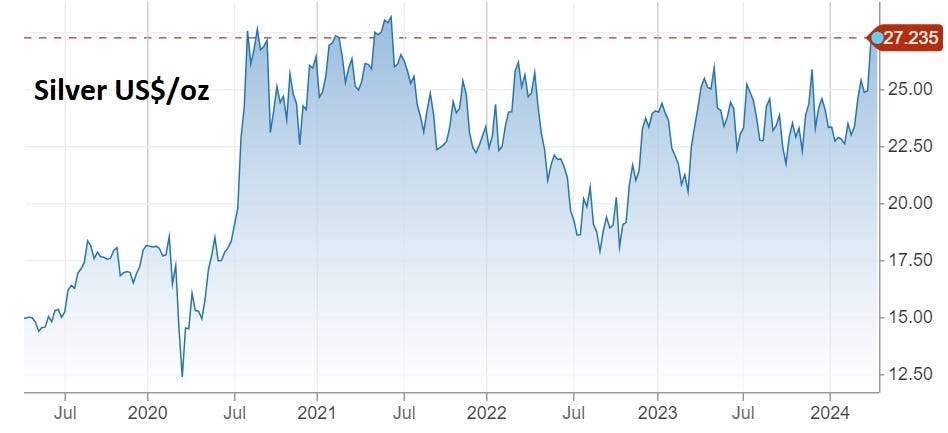

I am trying to diversify my new cash while favoring gold mostly. I am not buying anymore silver because it is too heavy. If gold dips I will buy more, but if it continues to $2500 I don't think I am a buyer.

Gold stackers have been waiting for this since $1500, but instead of euphoria I feel anxiety of what economic conditions are being telegraphed. I might even go long on a couple of stock/BTC ETFs to participate in the sugar high. I was able to buy 9 month CDs on Friday @ 5.35% from JP Morgan.

I am trying to diversify my new cash while favoring gold mostly. I am not buying anymore silver because it is too heavy. If gold dips I will buy more, but if it continues to $2500 I don't think I am a buyer.