You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Lunatic Fringe - Market and Trade Chat

- Thread starter TheRealZed

- Start date

-

- Tags

- markets

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

- Status

- Not open for further replies.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

Fascinating. When self-learning AI sees the world too clearly and thus comes to the “wrong” conclusions, you just lie to it using fake data. Problem solved.

when reality fails to align with your model, change reality

the fact that this is becoming a default human position should worry youboriquagato.substack.com

Yeah, for sure it is only as good as the text it reads, much like the majority of our modern academics. Independent thought is discouraged by our education systems, clever regurgitation of accepted data is all they ever want to see. In that respect AI will soon out perform most of modern academia but it will never be a modern Nikola Tesla. What it does do, at least in my mind, is point out that glaring flaw in our educational structures. We have largely been producing fleshy 'Chat GPT's' over finding and developing the types of minds with the potential to move us forward rapidly. The system hates mavericks, yet we need mavericks, indeed we celebrate the mavericks of the past.

Just a grumpy old opinion.

P.S. > If you have not already read, AI is wonderful at ignoring the intent (spirit) of the challenge place before it and end running the rules to arrive at a 'solution'. It's marvelous at cheating!

Cheers

Z

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

Long term investor is what you call yourself when you were wrong. He got more money than God no sweat off his a$$.

Rule makes the point that it's often the price that is wrong so you need to understand the value that you are getting. Really we revalue an entire company because a minor percentage of holders panicked (or got greedy) on a given day. That isn't rational, but it may be opportunity to buy or sell.

Lancers32

Often Wrong Never In Doubt

- Messages

- 1,845

- Reaction score

- 2,114

- Points

- 298

Contrary to him selling his Palladium then. This guy Rule does most of his buying in private placements I would bet and while he's gonna pay a buck you'll pay 2. Stock goes to 3 he's out you're wondering whether to take the 30% off the table he's already long gone.Rule makes the point that it's often the price that is wrong so you need to understand the value that you are getting. Really we revalue an entire company because a minor percentage of holders panicked (or got greedy) on a given day. That isn't rational, but it may be opportunity to buy or sell.

We play Sheen he plays Douglas. No risk for the big money.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

The price is the price. To suppose you know more than the market sets you up for failure.

Yeah, no.

The market isn't efficient, there are many people that know particular industries well enough to buy when the buying is dirt cheap and the price irrational.

Over the longer run price isn't as important as understanding the value you are getting.

If you are an investor, that is.

Trading is a different thing, all you care for there is sentiment as reflected in price for the short term.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

Contrary to him selling his Palladium then. This guy Rule does most of his buying in private placements I would bet and while he's gonna pay a buck you'll pay 2. Stock goes to 3 he's out you're wondering whether to take the 30% off the table he's already long gone.

We play Sheen he plays Douglas. No risk for the big money.

Yep, but he built his initial pile in the open market buying what he thought was value.

Lancers32

Often Wrong Never In Doubt

- Messages

- 1,845

- Reaction score

- 2,114

- Points

- 298

Agree to disagree. You'll run out of money betting the market is inefficient. After all he was big on Palladium then sold it rather quickly. This isn't some stock that can experience all types of problems. Over the long haul the only thing that matters is what you paid and what you got when you sold. Everything else is conversation.

- Messages

- 1,773

- Reaction score

- 2,080

- Points

- 283

Never short TSLA.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

You'll run out of money betting the market is inefficient.

If the market was efficient there would never be opportunity, period end of story. It's illogical to assume that perfect knowledge exists across a market. Odds are very much against that. Basically they are a football crowd reacting en-mass with emotion. Occasionally they are right, most often they are over or under.

That said the market is the best mechanism we have.

You are also assuming that there is no risk control in place or/and that the entity can't live with the draw down. Buffet etc often live with a draw down, in fact they continue buying as they are looking at is as income for 'life'. Business's they never really want to sell.

You have a traders mindset.

The other point is we are now at a point in time when we appear to be shifting from index buying being dominant to value buying. Index buying has been the goto for MOST of the industry for well over a decade now, due to Fed policy I suppose. Now it is looking very much like the value guys are going to get their time in the sun. Cycles etc... If we wash out big time it is my opinion that this time you will need to know what to buy as all boats will not float on the new tide.

JMO etc...

Last edited:

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

Never short TSLA.

Shorting religion is a wealth hazard!

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

Chat Bot for shits and giggles...

Compare the approaches of a value investor and a momentum trader.

Value investing and momentum trading are two different approaches to investing in the stock market.

Value investing involves finding stocks that are undervalued by the market, meaning they have a lower price than their intrinsic value. Value investors look for companies with strong fundamentals, such as a solid balance sheet, consistent earnings growth, and a low price-to-earnings ratio. The goal is to find stocks that are trading at a discount and hold them for the long term, waiting for the market to recognize their true value.

Momentum trading, on the other hand, involves buying stocks that have been performing well recently, with the belief that they will continue to do so in the short term. Momentum traders look for stocks with positive price momentum, meaning they have been trending upwards over the past few weeks or months. The goal is to capitalize on short-term market trends and make quick profits by buying and selling stocks quickly.

Here are some key differences between the two approaches:

Compare the approaches of a value investor and a momentum trader.

Value investing and momentum trading are two different approaches to investing in the stock market.

Value investing involves finding stocks that are undervalued by the market, meaning they have a lower price than their intrinsic value. Value investors look for companies with strong fundamentals, such as a solid balance sheet, consistent earnings growth, and a low price-to-earnings ratio. The goal is to find stocks that are trading at a discount and hold them for the long term, waiting for the market to recognize their true value.

Momentum trading, on the other hand, involves buying stocks that have been performing well recently, with the belief that they will continue to do so in the short term. Momentum traders look for stocks with positive price momentum, meaning they have been trending upwards over the past few weeks or months. The goal is to capitalize on short-term market trends and make quick profits by buying and selling stocks quickly.

Here are some key differences between the two approaches:

- Investment horizon: Value investing is a long-term strategy, with investors typically holding their positions for several years. Momentum trading is a short-term strategy, with traders often holding positions for just a few days or weeks.

- Focus: Value investors focus on a company's intrinsic value, while momentum traders focus on the stock's recent price movements.

- Risk: Value investing is generally considered a lower-risk strategy, as it involves investing in companies with strong fundamentals. Momentum trading is considered higher risk, as it involves taking advantage of short-term market trends that can change quickly.

- Trading style: Value investing is a more passive approach, with investors typically buying and holding their positions for the long term. Momentum trading is a more active approach, with traders frequently buying and selling stocks to capitalize on short-term trends.

- Messages

- 19,066

- Reaction score

- 11,456

- Points

- 288

or anything else for that matter....When chatgbt goes live with current data, how many traders are going to use it to identify top value stocks instead of doing in house analysis...

It's akin to today's yout utilizing Wikipedia as a valid source instead of a starting off point....

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

When chatgbt goes live with current data, how many traders are going to use it to identify top value stocks instead of doing in house analysis...

How much is Newmont Mining worth by traditional gold mining metrics?

Newmont Mining is one of the world's largest gold mining companies. However, since Newmont Mining merged with Goldcorp in 2019, it now operates as Newmont Corporation. As of February 28th, 2023, Newmont Corporation's market capitalization is approximately $52.3 billion USD, making it one of the largest gold mining companies in the world.

When evaluating a gold mining company, there are several metrics to consider beyond market capitalization. Some of the metrics commonly used in the industry include:

- Reserves: The amount of gold that a company has in proven and probable reserves is a critical metric in determining its long-term value. As of the end of 2021, Newmont Corporation had 94.2 million ounces of gold reserves.

- Production: The amount of gold produced by a company can also impact its value. In 2021, Newmont Corporation produced 5.8 million ounces of gold.

- All-in Sustaining Costs (AISC): This metric represents the total cost of producing an ounce of gold, including all direct and indirect costs associated with mining, processing, and refining. As of Q4 2021, Newmont Corporation's AISC was $1,007 per ounce.

- Price to Earnings (P/E) ratio: This metric compares the company's stock price to its earnings per share (EPS). As of February 28th, 2023, Newmont Corporation's P/E ratio was 11.13.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

Wouldn't that be wild if ChatGPT added footnotes/citations to it's commentaries...

How much is Newmont Mining worth by traditional gold mining metrics? Please cite the sources used in arriving at your response.

As previously stated, Newmont Mining merged with Goldcorp in 2019 and now operates as Newmont Corporation. Therefore, I will provide information on Newmont Corporation's value by traditional gold mining metrics as of February 28th, 2023, using publicly available sources.

- Reserves: According to Newmont Corporation's 2021 annual report, the company had 94.2 million ounces of gold reserves as of December 31st, 2021.

- Production: According to Newmont Corporation's 2021 fourth-quarter and full-year results, the company produced 5.8 million ounces of gold in 2021.

- All-in Sustaining Costs (AISC): According to Newmont Corporation's 2021 fourth-quarter and full-year results, the company's AISC was $1,007 per ounce in Q4 2021.

- Price to Earnings (P/E) ratio: As of February 28th, 2023, Newmont Corporation's P/E ratio was 11.13, based on data from Yahoo Finance.

- Market Capitalization: As of February 28th, 2023, Newmont Corporation's market capitalization was approximately $52.3 billion USD, based on data from Yahoo Finance.

- Newmont Corporation 2021 Annual Report: https://www.newmont.com/-/media/Fil...ual-report-pdf/Newmont-2021-Annual-Report.pdf

- Newmont Corporation 2021 Fourth Quarter and Full Year Results: https://www.newmont.com/investors/n...ns-and-Provides-Outlook-for-2022/default.aspx

- Yahoo Finance: https://finance.yahoo.com/quote/NEM/financials?p=NEM

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

Wouldn't that be wild if ChatGPT added footnotes/citations to it's commentaries...

Keeping in mind that this thing is a toddler at best you wonder what the potential is!

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

Aussie gold miners mildly in the green today.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

Where does ChatGPT get it's intel/info?

Google type web crawler with 'intelligence' applied. Only I'm sure the input list is curated... prolly no ZeroHedge!

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

I guess you could just ask chatgpt if it reads ZH...

Is the web site Zerohedge included in the text you where trained on?

Yes, as a language model, I was trained on a large corpus of text data, which includes a vast amount of web pages from different websites, including Zerohedge. However, my training data only goes up to September 2021, so I may not be aware of any changes or updates to the website that have occurred after that time.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

Where does ChatGPT get it's intel/info?

From the horses mouth...

As an AI language model, I do not have direct access to external sources of information or intelligence. Instead, I was trained on a large corpus of text data, which includes a diverse range of sources such as books, articles, news publications, and websites. My training data was sourced from various public databases, including the Common Crawl project and Wikipedia, as well as other sources that were licensed for use in AI research.

As a result, the knowledge and information that I provide are based solely on patterns and relationships in the language used in the text data I was trained on. I do not have access to current events or up-to-date information that may not have been included in my training data. Additionally, while I strive to provide accurate and informative responses, I am still an artificial intelligence and may make errors or misunderstandings in some cases.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

The last time today's guest expert was on this channel, he predicted a rocky road ahead for the global economy, that will eventually culminate in the massive pile of $trillions in global unserviceable debt going into default causing a worldwide depression by 2025. Since his last appearance, the markets have become a lot more optimistic, US GDP has perked up a bit, and inflation has been marching downwards -- albeit more slowly than the central banks would like. Today we'll ask copper expert & macro analyst Simon Hunt whether his dire forecast has improved at all. Or perhaps, gotten even worse.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

So, ChatGPT is Cliff High in digital form...

With more self control....

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

So, ChatGPT is Cliff High in digital form...

Sorry, but not even close. It's good at regurgitating a bunch of data quickly but there is not much ability to think their yet. It might make a decent doctor or lawyer and mundane writing tasks but no.

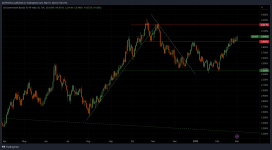

TLT is breaking down and looks like it will at Least test a double bottom which means revisiting interest rate highs. If that breaks then holy heck is going to break loose. Bear SMASH.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

TLT is breaking down and looks like it will at Least test a double bottom which means revisiting interest rate highs. If that breaks then holy heck is going to break loose. Bear SMASH.

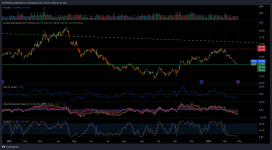

I wouldn't say that just yet, still holding over 100, sub 100 it looks like another leg down. For now it's still in range with no new lower low.

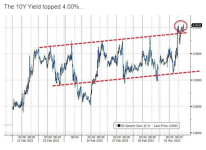

That said the ten year note yield looks to be breaking out of it's recent range so a break down might be close. However the 20 year (TLT) is still in its range.

I wouldn't say that just yet, still holding over 100, sub 100 it looks like another leg down. For now it's still in range with no new lower low.

That said the ten year note yield looks to be breaking out of it's recent range so a break down might be close. However the 20 year (TLT) is still in its range.

View attachment 7049

Yeah the yields show it better, in ZH daily wrap up. That looks like a break-out and retest.

Bitcoin & Bullion Jump, Bonds & Big-Tech Dump As Stagflation Signs Soar | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

Silvergate blowing up..

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

Get long AI!

- Status

- Not open for further replies.