"Ask ChatGPT to write a research report on the 2023 global market outlook."

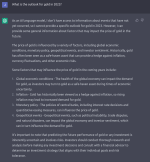

Sure, here's a research report on the 2023 global market outlook:

Executive Summary:

The global market is expected to continue its growth trajectory in 2023, with a projected increase in global GDP, continued technological advancements, and expanding consumer markets. However, there are also several risks and uncertainties that could impact the global economy, including geopolitical tensions, trade conflicts, and potential natural disasters. Key sectors that are expected to drive growth in 2023 include technology, healthcare, and renewable energy.

Global Economic Outlook:

The global economy is expected to continue its growth trajectory in 2023, with the IMF projecting a 4.4% increase in global GDP. This is an improvement from the 3.9% growth seen in 2022, driven largely by recovering economies from the COVID-19 pandemic, strong consumer demand, and government stimulus measures. However, there are several risks and uncertainties that could impact global growth, including ongoing geopolitical tensions, trade conflicts, and the potential for natural disasters.

Key Sectors:

Technology is expected to continue to be a key driver of growth in 2023, as businesses and consumers increasingly rely on digital technologies for communication, commerce, and entertainment. Emerging technologies such as artificial intelligence, blockchain, and 5G networks are also expected to play a significant role in shaping the global economy.

The healthcare sector is also expected to see strong growth in 2023, as aging populations and increasing healthcare needs drive demand for medical devices, pharmaceuticals, and healthcare services. The ongoing COVID-19 pandemic is also expected to drive continued investment in healthcare and biotech research.

Finally, renewable energy is expected to see significant growth in 2023, driven by increasing concerns about climate change and the need for more sustainable energy sources. Solar and wind power are expected to see particularly strong growth, as costs continue to decrease and demand increases.

Risks and Uncertainties:

There are several risks and uncertainties that could impact the global economy in 2023, including ongoing geopolitical tensions, trade conflicts, and the potential for natural disasters. The ongoing COVID-19 pandemic also remains a significant risk, particularly if new variants emerge that are more resistant to existing vaccines.

Other potential risks include a sharp increase in inflation, which could impact consumer demand and drive up interest rates, as well as the potential for increased regulation in key sectors such as technology and finance.

Conclusion:

Overall, the global market is expected to continue its growth trajectory in 2023, driven by a combination of technological advancements, expanding consumer markets, and government stimulus measures. However, there are also several risks and uncertainties that could impact global growth, and businesses will need to remain vigilant and adaptable in the face of these challenges. Key sectors such as technology, healthcare, and renewable energy are expected to see strong growth, and businesses that can effectively leverage these trends are likely to be well-positioned for success in the coming year.