A Debt based system must ALWAYS expand in order to be able to pay interest. As soon as that stops it collapses.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Lunatic Fringe - Market and Trade Chat

- Thread starter TheRealZed

- Start date

-

- Tags

- markets

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

- Status

- Not open for further replies.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

A Debt based system must ALWAYS expand in order to be able to pay interest. As soon as that stops it collapses.

Well there was a time when default and failure relieved the need to expand the money base to cover all debts. Remeber when bad ideas failed and good ideas won? Back in the bad old dayz?

...

Thursday, the U.S. Labor Department said weekly jobless claims jumped by 21,000 to 211,000, up from the previous week's unrevised estimate of 190,000 claims.

The latest labor market data missed expectations as economists were looking for claims to remain below 200,000 at around 195,000.

...

Gold prices near session highs as U.S. weekly jobless claims rise back above 200K, hitting a nine-week high

(Kitco News) - The U.S. labor market lost some momentum last week as the number of workers applying for first-time unemployment benefits jumped to a nine-week high.

www.kitco.com

A sign of disinflation. JPow likey.

Well there was a time when default and failure relieved the need to expand the money base to cover all debts. Remeber when bad ideas failed and good ideas won? Back in the bad old dayz?

That was back when the system is not nearing it's maximum expansion. Then the individual failures can be allowed and compartmentalized fairly easily and not threaten the entire system. That time appears over.

- Messages

- 19,650

- Reaction score

- 11,668

- Points

- 288

Like back in the day when banks were 'merging' with 'other' banks....That was back when the system is not nearing it's maximum expansion. Then the individual failures can be allowed and compartmentalized fairly easily and not threaten the entire system. That time appears over.

"Merging with banks" sounds so much better than 'Banks that were insolvent'.

Like back in the day when banks were 'merging' with 'other' banks....

"Merging with banks" sounds so much better than 'Banks that were insolvent'.

It's more about the ability of the system to be able to pay off the debt. Eventually though, you run out of any expansion opportunities and the economy cannot keep expanding in order to be able to service that debt. As interest rates rise now it should pop this bubble pretty SOONtm.

On the heels of Silvergate...

www.marketwatch.com

www.marketwatch.com

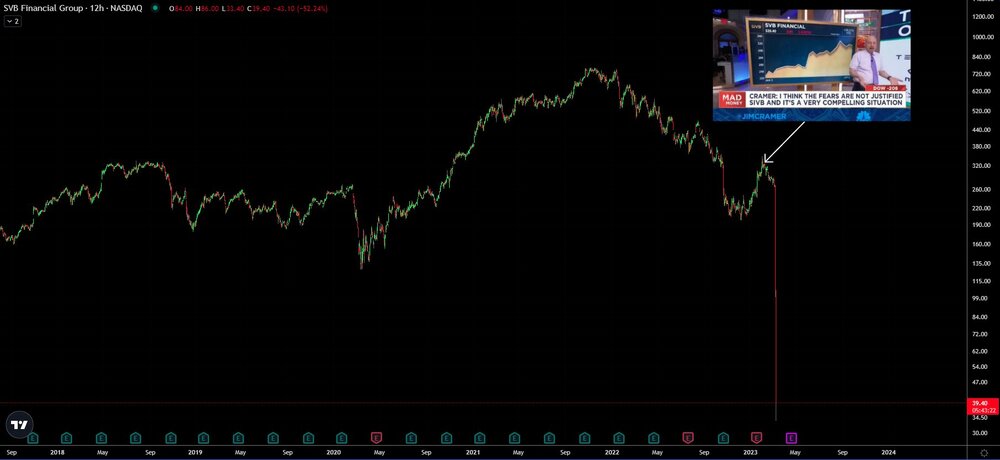

SVB Financial stock tumbles 22% after hours on reports of funds advising clients to pull money from bank

SVB Financial Group fell more than 22% in the extended session Thursday as reports surfaced that several funds are advising clients to pull their money from...

Shares of SVB Financial Group, known as Silicon Valley Bank, tumbled for a second day Friday and weighed on the entire banking sector again on concern that more banks would incur heavy losses on their bond portfolios.

SVB's CEO Greg Becker held a call with clients Thursday afternoon to calm their fears, CNBC learned, after a 60% tumble in the stock that day. The shares were down another 62% in premarket trading Friday before they were halted for pending news. They did not open for trading with the market at 9:30 a.m.

...

The SPDR S&P Regional Banking ETF was off another 5% Friday following an 8% tumble on Thursday. The Financial Select SPDR Fund was down by 1.6% following a 4% decline on Thursday. Signature Bank, which is known to cater to the crypto sector, was off 18% in following a 12% tumble Thursday. First Republic Bank was off 31% following a 17% tumble on Thursday. PacWest Bancorp was down 23%. Many of these regional bank shares were halted for volatility repeatedly.

Major banks were holding up better than regional banks with JPMorgan Chase up 1.4% Friday after tumbling 5% on Thursday.

...

Contagion fears for the banking sector...

...

Nonfarm payrolls rose by 311,000 for the month, the Labor Department reported Friday. That was above the 225,000 Dow Jones estimate and a sign that the employment market is still hot.

...

Payrolls rose 311,000 in February, more than expected, showing solid growth

Nonfarm payrolls were expected to increase by 225,000 in February, while the unemployment rate was projected to hold at 3.4%, according to Dow Jones.

JPow is not happy.

- Messages

- 19,650

- Reaction score

- 11,668

- Points

- 288

That's the shit!Although I am holding PTGX with a 91.58% gain... Generally the Weekend Trend Trader system is getting Thrashed and Trashed this week.

I never have that problem...[Like being boiled in oil.] #Next1000Trades

I'm watching the parade from the curb....

Contagion fears for the banking sector...

AND IT's GONE. Shut down by the FDIC.

U.S. Treasury Secretary Janet Yellen said Friday she’s tracking a number of banks as Silicon Valley Bank has faced major problems.

...

Treasury monitoring a few banks 'very carefully' amid Silicon Valley Bank's woes, Yellen says

U.S. Treasury Secretary Janet Yellen says Friday she's tracking a number of banks as Silicon Valley Bank has faced major problems.

...

John McLaughlin: ... Issue number 5: what number am I thinking of? Pat Buchanan!

Pat Buchanan: Geez, uh, 82?

John McLaughlin: Wrong! Eleanor Clift!

Eleanor Clift: Is it between 1 and..

John McLaughlin: Don’t skirt the issue!

Eleanor Clift: Uh.. 40!

John McLaughlin: Wrong! Mortontyne!

Morton Kondracke: 212?

John McLaughlin: Wrong! Jackareeno!

Jack Germonde: 2?

John McLaughlin: Wrong! The correct answer is 134. 134.

...

@2:28 mark...

- Messages

- 19,650

- Reaction score

- 11,668

- Points

- 288

Who's going bankrupt today?

I repeat myself....AND IT's GONE. Shut down by the FDIC.

FDIC formed a Bridge Bank to handle SVB:

www.fdic.gov

www.fdic.gov

For Immediate Release

WASHINGTON – Silicon Valley Bank, Santa Clara, California, was closed today by the California Department of Financial Protection and Innovation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect insured depositors, the FDIC created the Deposit Insurance National Bank of Santa Clara (DINB). At the time of closing, the FDIC as receiver immediately transferred to the DINB all insured deposits of Silicon Valley Bank.

All insured depositors will have full access to their insured deposits no later than Monday morning, March 13, 2023. The FDIC will pay uninsured depositors an advance dividend within the next week. Uninsured depositors will receive a receivership certificate for the remaining amount of their uninsured funds. As the FDIC sells the assets of Silicon Valley Bank, future dividend payments may be made to uninsured depositors.

Silicon Valley Bank had 17 branches in California and Massachusetts. The main office and all branches of Silicon Valley Bank will reopen on Monday, March 13, 2023. The DINB will maintain Silicon Valley Bank’s normal business hours. Banking activities will resume no later than Monday, March 13, including on-line banking and other services. Silicon Valley Bank’s official checks will continue to clear. Under the Federal Deposit Insurance Act, the FDIC may create a DINB to ensure that customers have continued access to their insured funds.

As of December 31, 2022, Silicon Valley Bank had approximately $209.0 billion in total assets and about $175.4 billion in total deposits. At the time of closing, the amount of deposits in excess of the insurance limits was undetermined. The amount of uninsured deposits will be determined once the FDIC obtains additional information from the bank and customers.

Customers with accounts in excess of $250,000 should contact the FDIC toll-free at 1-866-799-0959.

The FDIC as receiver will retain all the assets from Silicon Valley Bank for later disposition. Loan customers should continue to make their payments as usual.

Silicon Valley Bank is the first FDIC-insured institution to fail this year. The last FDIC-insured institution to close was Almena State Bank, Almena, Kansas, on October 23, 2020.

FDIC Creates a Deposit Insurance National Bank of Santa Clara to Protect Insured Depositors of Silicon Valley Bank, Santa Clara, California

FDIC Creates a Deposit Insurance National Bank of Santa Clara to Protect Insured Depositors of Silicon Valley Bank, Santa Clara, California

...

2. What is bridge bank, how does it?

A bridge bank is a new national bank chartered by the Office of the Comptroller of the Currency (OCC) and controlled by the FDIC in accordance with section 11 ( n ) of the Federal Deposit Insurance Act.

Creating a bridge bank permits parallel functions to continue. First, the bridge bank allows client banks to maintain their correspondent banking relationship with the least amount of disruption. ... Secondly, operating a bridge bank allows FDIC's preexisting efforts to market the bank to continue. Thirdly, operating the bridge bank allows time for the failed bank to be liquidated in an orderly fashion if marketing efforts are unsuccessful.

...

Question and Answer Guide for Silverton Bank, N.A., Atlanta, GA | FDIC.gov

Question and Answer Guide for Silverton Bank, N.A., Atlanta, GA

www.fdic.gov

www.fdic.gov

- Messages

- 19,650

- Reaction score

- 11,668

- Points

- 288

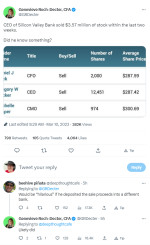

I wonder who that lucky individual might be and will it end up being 'investigated'.....

- Messages

- 19,650

- Reaction score

- 11,668

- Points

- 288

Lancers32

Often Wrong Never In Doubt

- Messages

- 1,867

- Reaction score

- 2,141

- Points

- 298

- Messages

- 1,849

- Reaction score

- 2,200

- Points

- 283

My GLD calls made me happy.How dem miners doin today?

The contagion will go beyond banks. In fact, the larger, better capitalized banks will probably not feel this much.

The spread is going to be to all the companies that held their accounts at SVB. The majority of high tech companies in silicon valley have accounts there. Companies like Roku, Shopify, ZipRecruiter. They stand to lose a lot of money. Most will be unable to make their next payroll or debt service payments.

Real estate? What if your landlord has their accounts with SVB? Not a big deal, if you can still make your rent payments, right?

What happens when the landlord can't make their debt service/mortgage payments? When the building is eventually foreclosed on, what will happen to you? And don't expect to get your security deposit (into six digits in the case of high end real estate) back, as that was held at SVB too.

The contagion from this will spread far and wide.

(and yes, I posted the same thing in the SVB thread on the other site)

The spread is going to be to all the companies that held their accounts at SVB. The majority of high tech companies in silicon valley have accounts there. Companies like Roku, Shopify, ZipRecruiter. They stand to lose a lot of money. Most will be unable to make their next payroll or debt service payments.

Real estate? What if your landlord has their accounts with SVB? Not a big deal, if you can still make your rent payments, right?

What happens when the landlord can't make their debt service/mortgage payments? When the building is eventually foreclosed on, what will happen to you? And don't expect to get your security deposit (into six digits in the case of high end real estate) back, as that was held at SVB too.

The contagion from this will spread far and wide.

(and yes, I posted the same thing in the SVB thread on the other site)

- Messages

- 1,849

- Reaction score

- 2,200

- Points

- 283

so, only 151 billion is uninsured. Not that much really when it comes to banks. A rounding error when it comes to fed gov. If they are deemed TBTF then 200 billion shows up on their books by Monday. If not then depositors take a hit.

Scrutiny Falls on $43B USDC Stablecoin’s Cash Reserves at Failed Silicon Valley Bank

Circle’s USDC, the second-largest stablecoin, with $43 billion market capitalization, held an undisclosed part of its $9.8 billion cash reserves at failed Silicon Valley Bank.

By Krisztian SandorMar 10, 2023 at 12:35 p.m. MST

Updated Mar 10, 2023 at 6:11 p.m. MST

(Sandali Handagama/CoinDesk)

Jenny Johnson

President and CEO

Franklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon...

Secure Your Seat

U.S.-based stablecoin issuer Circle held a part of its USDC stablecoin’s cash reserves at Silicon Valley Bank as of Jan. 17, according to the firm's latest attestation.

USDC is the second-largest stablecoin on the market, with a $43 billion circulating supply that is fully backed by government bonds and cash-like assets.

Read More: USDC Stablecoin Depegs From $1; Circle Says Operations Are Normal

BTC$20,476.32

BTC$20,476.322.28%

ETH$1,469.69

ETH$1,469.693.46%

BNB$280.24

BNB$280.242.36%

XRP$0.37073142

XRP$0.370731420.20%

APT$10.67

APT$10.675.77%

View All Prices

According to Circle’s January reserve report, the firm held some $9.88 billion of cash deposited at regulated banks to back USDC’s value. According to Circle's website on March 10, cash deposits in the reserves amounted to $11.1 billion.

USDC’s banking partners included Silicon Valley Bank (SVB), the California-based bank that was taken over by regulators and shut down on Friday.

The full list of banks that held cash for Circle’s USDC are Bank of New York Mellon, Citizens Trust Bank, Customers Bank, New York Community Bank (a division of Flagstar Bank, N.A.), Signature Bank, Silicon Valley Bank and Silvergate Bank. Circle also keeps some part of USDC reserves in a dedicated BlackRock fund.

Circle said last week it had cut ties with Silvergate Bank, the crypto-friendly bank that halted operations and said it would “voluntarily liquidate” its assets earlier this week.

Signature Bank’s holding company’s (SI) shares have dropped 12% on the news about SVB’s shutdown. Signature said in December that it would reduce deposits tied to crypto firms by as much as $10 billion.

Circle spokesperson said late Friday that SBV was one of the six banks that the firm used "for managing the approximately 25% portion of USDC reserves held in cash."

"While we await clarity on how the FDIC receivership of Silicon Valley Bank will impact its depositors, Circle and USDC continue to operate normally," according to the statement.

Simon Dixon, CEO of online investment platform BnkToTheFuture, tweeted that Circle's chief executive Jeremy Allaire said the firm held "most of their cash is in BNY Melon," while sharing a screenshot from March 2. BnkToTheFuture is an investor and shareholder in Circle.Silicon Valley Bank is one of six banking partners Circle uses for managing the ~25% portion of USDC reserves held in cash. While we await clarity on how the FDIC receivership of SVB will impact its depositors, Circle & USDC continue to operate normally.https://t.co/NU82jnajjY

— Circle (@circle) March 10, 2023

The recent failure of crypto- and tech-focused banks investors has rattled investors, causing crypto markets to crash. Bitcoin (BTC), the largest cryptocurrency by market capitalization, fell below the psychologically important $20,000 level, the lowest since January.

Last edited by a moderator:

- Status

- Not open for further replies.