...

Assets moving in tandem is the theme of our call of the day, from TheoTrade’s chief market technician, Jeff Bierman, who sees dark clouds gathering for markets due to “asset auto correlation overload.”

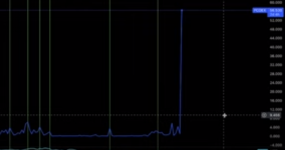

Bierman, an adjunct instructor at Loyola University’s business school, explains that bitcoin, gold, the S&P 500, bonds and oil have been “moving together in automatic serial correlation, driven simultaneously by algos,” that is, computer-driven trading algorithms used by Wall Street firms, hedge funds and other big investors.

“There’s nowhere to hide, no diversification in this type of market. This is a black swan event. It’s a bubble that can be burst at any time by an exogenous cataclysmic risk event or any number of factors,” Bierman tells client in a new note, adding that it’s “highly likely” this will mark the beginning of the end of the 2023 stock market rally.

...

Bierman notes that almost every stock outside of financials has rallied to the point of being priced for perfection and beyond, with expectations also too high. ...