This is NOT investment advice... But anyone who thinks there is a plan running and trump is in charge.

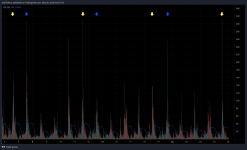

Buy yourself some BBBYQ for like a quarter. I don't care if you throw $10 into it. But I believe there is a plan in place for a restructuring buyout. The deadline for bids is looking like June 1st. Not all brokers will even allow you to buy it but if you can and know how to trade stocks it's Well worth the shot IMO.

Enjoy the Show

Is it also a Cohensidence that the debt ceiling x date is Also June 1st? And Clif has been talking about June for some time. Oh and school gets out June 1st, at least for our school...