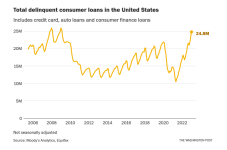

Silvergate blowing up..

Interesting, it is down 30% after hours. I'm pretty surprised after all the Dirty Billionaires recently pouring money into the thing. Guys like Ken Griffin (meme stock enemy #1), Soros, etc.

Silvergate slumps 28% after delaying annual report, warning about viability

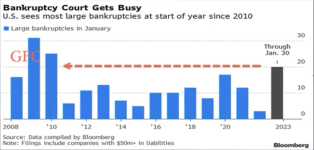

Silvergate had been trying to ease investor concerns over its future after reporting a $1 billion loss for the fourth quarter in the wake of crypto exchange FTX's bankruptcy, which shook confidence in the digital asset sector. Federal prosecutors in Washington are probing Silvergate and its...

Just going to guess that this is part of the FTX/global money laundering scam that has been imploding.

Ken Griffin Is Buying One of the Most Shorted Stocks In the Market | The Motley Fool

Ken Griffin is the CEO of the hedge fund and market maker Citadel Securities.

Gotta love this -> Citadel purchased a more than 5% stake in a stock