jelly

Predaceous Stink Bug

- Messages

- 159

- Reaction score

- 265

- Points

- 198

Suspicious isn't it? Are gold miners sniffing out a crash in the system, coming soon? It makes you wonder...

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

but the tax payer won't have to pay anything and everyone will get bailed out

joe said so. . .

Right. If and when Joe six-pack actually figures that out, gold (and silver) go brrr as well. If and when...Money printer go brrrrrrrr.... FREE! See?

Yeah, and Joey said..."the vax is safe", in a calm voice, and as time went on he eventually yelled, "get the vax", and ended with, "It's gonna be a cold winter, you stupid mf'ers!"...something like that, and now, in a calm voice, the banks are safe.Money printer go brrrrrrrr.... FREE! See?

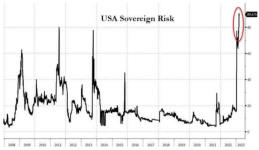

Here is a good explanation for why I used the term "risk off" yesterday, w/o regard to any Bloomberg terminal. When you see these things, it is risk off.

View attachment 7396

It's funny how gold alternates between a risk on and risk off asset depending on the tail that's being spun. For many years back there wallstreet was pushing gold as a risk asset.

Seems like everyone overlooking the rate hike coming next week. ECB raised .5 today so no worries about the banks over there. Stock market up. Gold up. Unemployment low. Why wouldn't JP raise rates next week? At least .25.

interesting development...

I watched it, probably not as attentively as I should have, and also had a tough time always understanding everything the guy who was being interviewed said. Nonetheless, it was striking just how 'in your face' the stuff is. My daughter embraces it. Hope she don't wind up putting her old man in some sort of AI nursing home one day... not that I would know it, I'm sure.PS -> That AI vid is really worth a watch, this thing is on a tear and it's easy to not get the extent of developments.

Interesting. metal are currently being spanked at the Asian open. Wonder if the ASX is trying to catch up to where the Comex/Globex made it to on Friday?ASX Gold Tribe are a bit hot this AM, sitting around +7%

ASX Gold Tribe are a bit hot this AM, sitting around +7%

Pretty damn ferocious.8% @ the close.

Interesting. metal are currently being spanked at the Asian open. Wonder if the ASX is trying to catch up to where the Comex/Globex made it to on Friday?

Wow. That chart is quite the statement. Wonder if time zones aren't the only thing you Aussie's are just slightly ahead of us on?

Wow. That chart is quite the statement. Wonder if time zones aren't the only thing you Aussie's are just slightly ahead of us on?

The Federal Reserve will close its two-day meeting Wednesday with a heavy air of uncertainty as the central bank moves forward in its efforts to bring down inflation and stabilize the troubled banking sector.

At the moment, those two goals seem to be in conflict: Getting inflation down requires the same higher interest rates that have inflicted crisis-level effects on banks.

Still, after much volatility markets seem to have coalesced around expectations that the rate-setting Federal Open Market Committee will approve a 0.25 percentage point, or 25 basis point, increase.

But that won't be all that policymakers will have to address.

They're also on tap to update rate and economic projections, and Fed Chairman Jerome Powell then will have to explain it all at his post-meeting news conference.

Here's a quick look at everything likely to happen.

...

Yeah I know the news wasn't good but First Majestic might be worth a punt after yesterday's debacle.