You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Lunatic Fringe - Market and Trade Chat

- Thread starter TheRealZed

- Start date

-

- Tags

- markets

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

- Status

- Not open for further replies.

Jodster

Fly on the Wall

Just as some confirmation, I’m waiting for a pullback to buy some more Ag.No rockets or beach balls posted, so you know, that's kinda good.

Last time I waited for a pullback to buy, silver was $28 and GIM Strawboss said it was going to $22.

Took damn near 5 years to drop that far.

Since I’m always wrong and I’m waiting for a dip, there’s your answer

Up, up and away...

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

I remember back when a $0.50 rise in POG would elicit "The End is Nigh!" excitements.

I remember a $0.50 rise in silver, it shocked everyone.

- Messages

- 153

- Reaction score

- 266

- Points

- 198

Demand seems to be very high at the small dealer level. I'm seeing premiums move up fairly quickly. No one has really been paying attention to silver... and that is when we are most likely to see the start a genuine move. 2c...As gold bounces around between 1950 and 2000, silver seems to be enjoying a little momentum.

The best time to buy is usually when everyone is falling all over themselves to buy.

View attachment 7803

You might buy a few puts as a hedge but Its surely not a time to sell the real stuff. That could cause one heck of a gamma squeeze.

Lancers32

Often Wrong Never In Doubt

- Messages

- 1,863

- Reaction score

- 2,137

- Points

- 298

Real stuff never was for trading.You might buy a few puts as a hedge but Its surely not a time to sell the real stuff. That could cause one heck of a gamma squeeze.

Armstrong has next week for a directional change and May is panic cycle.

Viking

Yellow Jacket

Viking

Yellow Jacket

- Messages

- 19,416

- Reaction score

- 11,581

- Points

- 288

Told my CPA yesterday about BRICS and how they're all making 'other plans' to use their currencies for trade instead of the almighty.

He was looking at me as if I had two heads.

Told him that's why I got a lotto ticket buying RGLD a few years ago. Riding it high, riding it low...

Now he knows why I have RGLD!

He was looking at me as if I had two heads.

Told him that's why I got a lotto ticket buying RGLD a few years ago. Riding it high, riding it low...

Now he knows why I have RGLD!

jelly

Predaceous Stink Bug

- Messages

- 159

- Reaction score

- 265

- Points

- 198

Positive quarterly close in the metals. If memory serves me correct, usually the next few days see a nice move UP, as money flows into the metals following the positive quarterly close. People who have zero interest in gold are taking notice now...

- Messages

- 19,416

- Reaction score

- 11,581

- Points

- 288

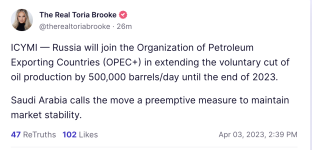

HERE WE GO: Saudis to Cut Oil Production by 500,000 Barrels Per Day Until End of 2023

Jodster

Fly on the Wall

Weekly Recap . . How will the markets react to this clusterfunk?

1) Saudi Arabia enters trade alliance with China, Russia, India, Pakistan, and four Central Asian nations to step further away from reliance on the US dollar.

Saudi Arabia enters trade alliance with China, Russia, India, Pakistan, and four Central Asian nations to step further away from reliance on the US dollar.

2) China and France complete first LNG gas trade using Chinese Yuan, ending reliance on the US dollar for energy trades.

China and France complete first LNG gas trade using Chinese Yuan, ending reliance on the US dollar for energy trades.

3) China and Brazil to settle trades in their own currencies, ditching the US dollar.

China and Brazil to settle trades in their own currencies, ditching the US dollar.

4) Brazil, Russia, India, China, and South Africa (BRICS) are developing a new currency, State Duma Deputy Chairman says.

5) Saudi Arabia partners with China to build a Chinese oil refinery for 83.7 billion yuan ($12.2 billion).

Saudi Arabia partners with China to build a Chinese oil refinery for 83.7 billion yuan ($12.2 billion).

6) Kenya signs deal with Saudi Arabia and UAE to buy oil with Kenyan shillings instead of US dollars.

Kenya signs deal with Saudi Arabia and UAE to buy oil with Kenyan shillings instead of US dollars.

7) President of Kenya tells citizens to get rid of US dollars.

President of Kenya tells citizens to get rid of US dollars.

8) Association of Southeast Asian Nations considers dropping the US dollar, euro, yen, and British pound for local currency financial settlements.

9) El Salvador President officially signs bill eliminating all taxes on income, property, and capital gains for technology innovations.

El Salvador President officially signs bill eliminating all taxes on income, property, and capital gains for technology innovations.

10) US Senator Elizabeth Warren launches "anti-crypto" re-election campaign.

US Senator Elizabeth Warren launches "anti-crypto" re-election campaign.

11) India to settle trade in Indian rupees with certain countries instead of US dollars, Commerce Secretary says.

India to settle trade in Indian rupees with certain countries instead of US dollars, Commerce Secretary says.

12) Chinese yuan surpasses the euro to become Brazil's second-largest currency in foreign reserves.

Chinese yuan surpasses the euro to become Brazil's second-largest currency in foreign reserves.

13) US government to sell 41,500 #Bitcoin ($1.18 billion) connected to Silk Road, in four batches this year.

US government to sell 41,500 #Bitcoin ($1.18 billion) connected to Silk Road, in four batches this year.

14) Hong Kong regulators to assist #crypto firms with banking in effort to become a digital asset hub.

Hong Kong regulators to assist #crypto firms with banking in effort to become a digital asset hub.

15) #Binance and CEO sued by US CFTC over alleged regulatory violations

16) US Social Security funds are projected to run out by 2033, Reuters reports.

US Social Security funds are projected to run out by 2033, Reuters reports.

17) 5 major banks raided by French authorities in €100 billion fraud investigation

5 major banks raided by French authorities in €100 billion fraud investigation

18) Former President Trump says President Biden is directly responsible for the bank failures and creating an economic catastrophe that will only get worse.

Former President Trump says President Biden is directly responsible for the bank failures and creating an economic catastrophe that will only get worse.

19) MicroStrategy purchases an additional 6,455 #Bitcoin ($150 million).

20) President Biden says the banking crisis is "not over yet."

President Biden says the banking crisis is "not over yet."

21 ) Saudi Arabia agreed to join the Shanghai Cooperation Organization as a dialogue partner. A China led security bloc.

Saudi Arabia agreed to join the Shanghai Cooperation Organization as a dialogue partner. A China led security bloc.

22 ) We learned that the BRICS reserve currency could be potentially backed by gold and other commodities, such as rare-earth elements.

23 ) NATO to fully adopt Finland

24 ) Hungary’s Prime Minister states NATO close to decision on sending peacekeeping troops to Ukraine.

Hungary’s Prime Minister states NATO close to decision on sending peacekeeping troops to Ukraine.

25 ) North Korea announced they will be sending 50,000 troops to Ukraine to fight along side with Russian troops.

North Korea announced they will be sending 50,000 troops to Ukraine to fight along side with Russian troops.

26 ) Putin signed decree to conscript 147,000 troops of next 3 months.

Putin signed decree to conscript 147,000 troops of next 3 months.

27 ) Satellite imagery shows increased activity at main North Korean nuclear site.

Satellite imagery shows increased activity at main North Korean nuclear site.

28 ) Bank deposits fell 126 billion this past week. 225 billion since the banking crisis started.

29 ) Mammals in California and Oregon test positive for H5N1 bird flu.

30 ) 33 tons of gold were withdrawn from JP Morgan vaults this week.

31 ) 4.8 million ounces of silver sold from the COMEX this week.

Twitter link here...

1)

2)

3)

4) Brazil, Russia, India, China, and South Africa (BRICS) are developing a new currency, State Duma Deputy Chairman says.

5)

6)

7)

8) Association of Southeast Asian Nations considers dropping the US dollar, euro, yen, and British pound for local currency financial settlements.

9)

10)

11)

12)

13)

14)

15) #Binance and CEO sued by US CFTC over alleged regulatory violations

16)

17)

18)

19) MicroStrategy purchases an additional 6,455 #Bitcoin ($150 million).

20)

21 )

22 ) We learned that the BRICS reserve currency could be potentially backed by gold and other commodities, such as rare-earth elements.

23 ) NATO to fully adopt Finland

24 )

25 )

26 )

27 )

28 ) Bank deposits fell 126 billion this past week. 225 billion since the banking crisis started.

29 ) Mammals in California and Oregon test positive for H5N1 bird flu.

30 ) 33 tons of gold were withdrawn from JP Morgan vaults this week.

31 ) 4.8 million ounces of silver sold from the COMEX this week.

Twitter link here...

Jodster

Fly on the Wall

Andy says he sold more silver in the last two weeks than he ever has in multiple months. Demand at all time high.

Listens well at 1.25x

Listens well at 1.25x

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

I think that the system hasn't seen enough stress for this to happen... if we where @ DXY 150/60 yeah then next move DOWN, but for now I think we are just in a mess and not really 'on the brink'...

JMO etc...

- Messages

- 153

- Reaction score

- 266

- Points

- 198

Nice to see someone sitting on the other side of the boat this weekend.I think that the system hasn't seen enough stress for this to happen... if we where @ DXY 150/60 yeah then next move DOWN, but for now I think we are just in a mess and not really 'on the brink'...

JMO etc...

I don't see all the dominoes lined up just now. Stonks had a bullish week...

Last edited:

- Messages

- 19,416

- Reaction score

- 11,581

- Points

- 288

Not saying they can't...Umm, money market funds can "break the buck" too. See 2008.

It is interested that TV commercials (don't watch much of that but on occasion) have been touting investing to the younger set of late. 'Manage your portfolio', 'be the boss of yourself' etc. IMO they're sucking in newbies to fleece.

Not saying they can't...

It is interested that TV commercials (don't watch much of that but on occasion) have been touting investing to the younger set of late. 'Manage your portfolio', 'be the boss of yourself' etc. IMO they're sucking in newbies to fleece.

And when that money figures it out what does a Trillion dollars in Gold and Silver look like?

- Messages

- 19,416

- Reaction score

- 11,581

- Points

- 288

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

- Messages

- 153

- Reaction score

- 266

- Points

- 198

Big push right across the board on the metals at the moment. Don't know what is powering it, but it looks and feels strong.Schwing... what is this? Right up against the top of the Silver resistance. Now it might get interesting.

View attachment 7916

Big push right across the board on the metals at the moment. Don't know what is powering it, but it looks and feels strong.

Me neither but this isn't quite normal for Gold and Silver. Especially at this time of day.

Duh...

Ahh great... well there is your cap for today

My best guess is Factory Order data at 9am and then Gold ran stop losses at $2,000

On a more serious note, I wonder if the price action in the metals might be driven by OPEC and the BRICS. OPEC's annoucements on production cuts should put upward pressure on oil prices which would likely increase inflation pressures (which would increase risk of market crashes). Flight to safety to the metals?

^ likely composed for publication before this morning's move.

Gold and silver continue to benefit from hedge funds ditching their bearish bets; with prices holding solid support levels, and generating upward momentum, new bullish bets are entering the marketplace, according to the latest trade data from the Commodity Futures Trading Commission.

The new bullish momentum comes as gold prices continue to test resistance around $2,000 an ounce and silver has broken a long-term downtrend as prices hold above $24 an ounce. Looking ahead, analysts note that bullish speculative positioning in both metals is well below historical norms, meaning there is plenty of upside for prices as more investors jump into the market.

...

Gold and silver see new bullish momentum as hedge funds ditch more bearish bets

Kitco News' general-interest stories takes a look at what is making headlines in the marketplace and how that is impacting precious metals prices

www.kitco.com

^ likely composed for publication before this morning's move.

- Messages

- 153

- Reaction score

- 266

- Points

- 198

I think it is becoming clear that the pivot is approaching. We have this incredible fundamental alignment in the metals space at the moment. I believe Zed was calling for a possible move last week. This is damn sure looking like it. we c...Another thought...

ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zerowww.zerohedge.com

Maybe the markets are anticipating the Fed will pause rate hikes since Canada and Australia have announced pauses.

- Messages

- 153

- Reaction score

- 266

- Points

- 198

TF Metals is saying the the Jobs/JOLTS report today was largely responsible for the metals spike. Reasoning is that the Fed has been using the tight labor market as a backstop to continue tightening. If this is no longer the case chances of further tightening diminish significantly. That, and other central banks taking a breather, as you pointed out.

TF Metals is saying the the Jobs/JOLTS report today was largely responsible for the metals spike. Reasoning is that the Fed has been using the tight labor market as a backstop to continue tightening. If this is no longer the case chances of further tightening diminish significantly. That, and other central banks taking a breather, as you pointed out.

That looks to be pretty accurate. Jolts was a big miss but it's made up junk anyway. Still can move markets if they believe it.

- Messages

- 153

- Reaction score

- 266

- Points

- 198

It is all theater. But if it scripts the play that the FED is acting in, it will capture a wide audience.That looks to be pretty accurate. Jolts was a big miss but it's made up junk anyway. Still can move markets if they believe it.

Last edited:

- Status

- Not open for further replies.