- Messages

- 36,740

- Reaction score

- 6,328

- Points

- 288

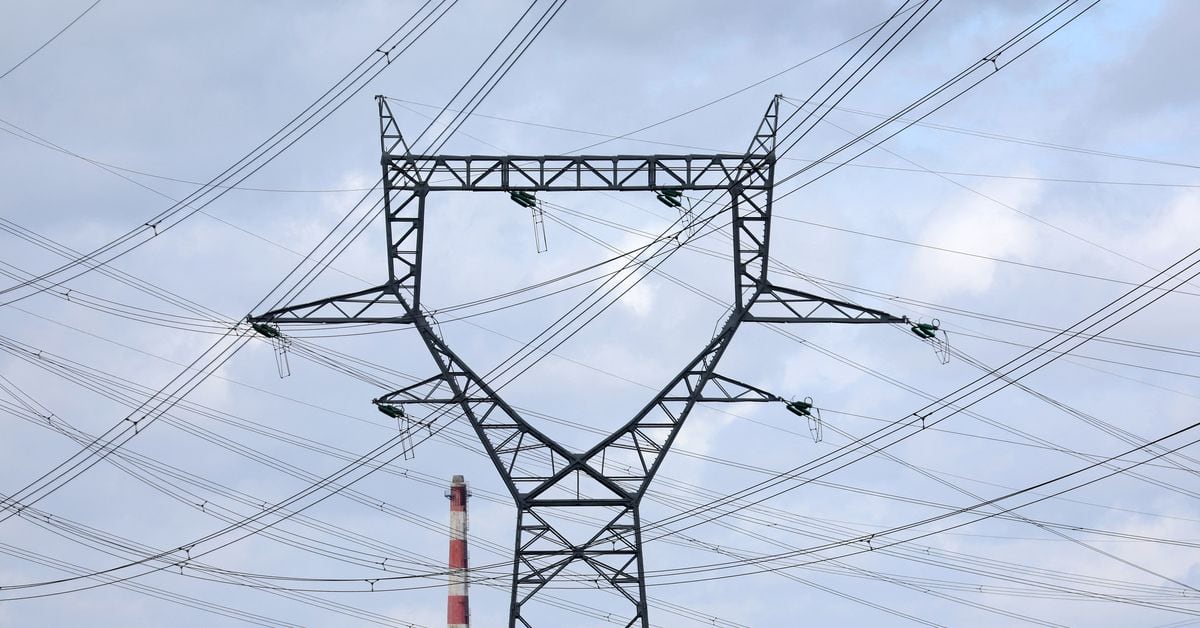

Europe’s summer of extremes triggers health warnings, nuclear output fears and shipping disruption

Europe's protracted battle with extreme weather conditions comes shortly after official data showed July was the hottest month in history.