Treasury yields were mixed Friday morning after data showed U.S. consumer sentiment rose in early February although inflation continued to weigh on the minds of many Americans.

...

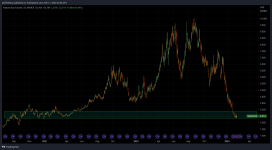

The spread between 10- and 2-year Treasury notes was slightly less inverted early Friday. The 10-year yield traded 79.7 basis points below the yield on the 2-year note. The spread finished the U.S. session on Thursday at minus 82.5 basis points.

An inversion of that measure of the yield curve, which typically slopes upward, is seen as a reliable recession indicator, though some analysts and economists, including the researcher who first popularized the relationship, have questioned its predictive power in the current environment.

...

Treasury yields hold steady after consumer sentiment report

Bond yields are mixed Friday morning after data showed U.S. consumer sentiment rose in early February.